Auto Enrolment total minimum contributions rise from 5% to 8%

What’s the change:

Since its introduction in 2012, over 10 million people have been automatically enrolled into a workplace pension. Upon launch, the total minimum contribution level was set at 2%, remaining at this level until April 2018 when it increased to 5%. From 6th April, this will rise further to a level of 8% of earnings between £6,136 and £50,000, incorporating a 3% employer contribution, a 4% employee contribution, and government tax relief topping this up by 1%*. The earnings trigger for automatic enrolment remains at £10,000 for 2019/20.

* The Pensions Regulator, Increase of automatic enrolment contributions

Steven Cameron, Pensions Director at Aegon, comments on the auto enrolment total minimum contributions rise: “The rise in minimum contribution levels for auto-enrolment is another step in the right direction for increasing long-term savings and we should applaud the role that auto-enrolment has played in kick-starting many people into saving for retirement. With employer contributions and government tax relief, savers see their personal contributions double.

“However, even with April’s rise, we need to help individuals understand that contributing just the minimum amount into their workplace pension is unlikely to provide the level of retirement income they aspire to and for that, they need to consider saving more.”

Pensions Lifetime Allowance

What’s the change:

The Lifetime Allowance (LTA) is the limit on the amount of pension benefit that can be built up in a pension without triggering an extra tax charge. The LTA is currently £1,030,000 and is rising in line with the Consumer Prices Index (CPI) to £1,055,000 on 6th April.*

*HM Treasury, Policy paper Budget 2018, section 4.5, Pensions and Saving Tax

Steven Cameron, Pensions Director at Aegon, comments the pensions lifetime allowance: “A pension pot at the lifetime allowance of £1.055 million may sound like a lot, but it won’t buy a ‘fat cat’ pension. We’d urge the Government to reverse previous cuts in the lifetime allowance, which stood at £1.8 million in 2012 or ideally scrap it altogether. We should be encouraging people to save more for longer lifespans in retirement and potential social care costs, not forcing them into early retirement to escape a tax bill.

“The impacts of both the lifetime allowance and also annual limits on pension contributions are a hot topic right now, with a particular focus on the NHS. But it’s not just NHS consultants who are impacted by these limits and we’d urge the Government to look more broadly at the negative impact pensions limits are having on many middle earners wanting to do the right thing and save for their retirement.”

State pension increases

What’s the change:

The state pension is currently protected by the ‘triple lock’ which means it increases by the highest of 2.5%, price inflation or average earnings growth. Those receiving the full-rate new state pension will see their payments increase by £4.25 per week from £164.35 to £168.60 from 6 April 2019. This equates to an extra £221 per year.

This 2.6% increase is based on average earnings growth for the year till September 2018, and is above the rate of price inflation for that period which was 2.4%.

Steven Cameron, Pensions Director at Aegon, comments on the state pension increase: “Those who are already receiving the state pension will enjoy a boost to payments on 6th April which for those receiving the full-rate new state pension will mean an additional £221 per year. Under the triple lock, introduced in 2010, the state pension has been rising at the highest of earnings inflation, price inflation or 2.5% a year.

“Whilst this has given pensioners a welcome boost above price inflation and helped to alleviate the financial burdens of many individuals, it does not come without a cost. And with people on average living longer than they used to, the Government is increasing the age at which people qualify for a state pension. By October 2020 it will rise from 65 to 66 and it is scheduled to increase to 67 between 2026 and 2028*. The change is particularly severe for women who previously received their state pension from age 60.”

*DWP, State Pension age review, July 2017

Changes to the personal allowance and income tax rate bands

What’s the change:

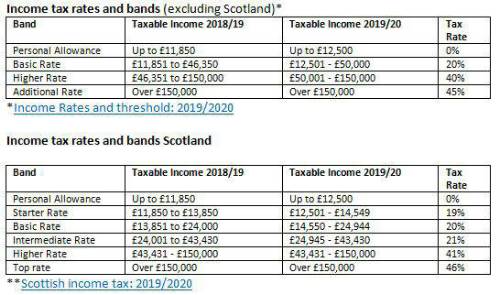

Personal allowance – The amount you can earn before paying income tax increases on 6th April from £11,850 to £12,500 throughout the UK.

Steven Cameron, Pensions Director at Aegon, comments on the changes to the personal allowance and income tax rate bands:

“For many individuals in the UK, the increase in the personal allowance on 6th April will mean an extra £650 of earnings is tax free, giving a welcome boost to take home pay.

“For those outside Scotland, raising the higher rate threshold to £50,000 means that £37,500 of income, or £3000 more than the previous year, is taxed at the basic rather than the higher rate. An individual earning £50k per year or more outside Scotland will pay £860 less income tax in the coming year. However, for employees, National Insurance will be paid at 12% on earnings up to £50k before falling to 2%, which cancels out £340 of the income tax saving, reducing the saving to £520 compared to the previous year.

“For an individual on the same £50k salary in Scotland, however, the changes mean they will have to pay out an extra £200 compared to the previous year, making them £720 worse off than their counterparts in the rest of the UK. Income tax bands and rates are ‘devolved’ to the Scottish Government which did not increase the higher rate tax threshold, meaning Scots start paying higher rate income tax on earning above £43,430. National Insurance contribution levels are not devolved, however, so those in Scotland pay the same higher NI contributions on earnings up to £50k as apply elsewhere in the UK.”

|