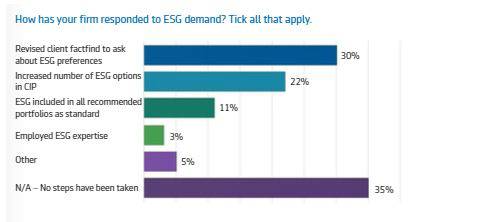

The most common change identified was that 30% of advisers have revised their client factfinds to specifically ask clients about their ESG preferences. It’s likely that the majority of advisers will follow as their clients demand access to greener investment options.

Another change made by more than one in five advisers (22%) was to increase the ESG options they offer through their CIPs, as the investment industry launches new broad-based and niche products to give consumers greater choice of investments that seek to benefit causes they hold dear. This goes beyond climate change to issues such as social justice and equality.

Less common but highlighting the significance of the trend was the move by 11% of adviser to add ESG to all recommended portfolios as part of their standard offering. And more will undoubtedly follow in an effort to get ahead of the curve when it comes to the inevitable legislation that is already making itself felt across the UK pensions industry following the DWP’s announcement to press ahead with new rules that will require trustees to report on their schemes' climate change investment risks by October.

Finally, 3% of advisers firms have bought in ESG expertise and it’s likely there will be increasing demand for experienced ESG specialists over the next few years as the industry skills up across the board.

Quote from Tim Orton, Managing Director, Aegon Investment Solutions: ‘UK savers put almost £1 billion a month on average into ESG funds in 2020, up 66% from the previous year and these findings highlight the changes taking place in the advice industry which are facilitating this movement of money. There is clear evidence that advisers are gearing up to meet rising demand from clients and we expect to see evidence of this increasing in future surveys. Adviser businesses, asset managers and providers alike will be upskilling, recruiting and re-structuring over the next few years to build the ESG capability they need to meet - not just increased demand from customers, but increased legislation from regulators.’

|