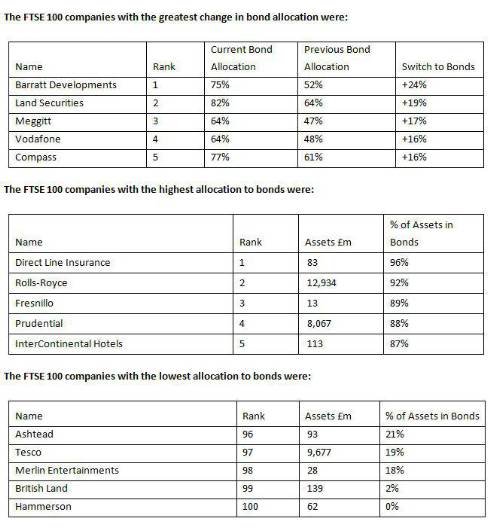

The average pension scheme asset allocation to bonds has increased from 56% to 59% in the year to 30 September 2015. Six years ago, the number was only 49%. A few companies reported very significant individual changes to investment strategies, with 11 FTSE 100 companies seeing their bond allocations altered by more than 10%. A total of 59 FTSE 100 companies have more than 50% of pension scheme assets in bonds.

The total deficit in FTSE 100 pension schemes has risen by £7 billion to £73 billion over the year to 30 September 2015.

Meanwhile, their total disclosed pension liabilities have risen from £591 billion to £614 billion.

Only 55 FTSE 100 companies are still providing more than a handful of current employees with DB benefits, ignoring companies who are incurring ongoing DB service costs of less than 1% of total payroll. Of these, less than a quarter (23) of the FTSE 100 companies are still providing DB benefits to a significant number of employees, defined as incurring ongoing DB service cost of more than 5% of total payroll.

Charles Cowling, Director, JLT Employee Benefits, comments: “The level of schemes’ bond holdings has reached a record high, which is good news in terms of lowered investment risks. It could also reflect greater prudence in trustees’ approach to risk management generally, which is very positive particularly as large deficits could tempt pension schemes to invest in higher growth, higher risk investments to make up for the shortfall.

“Despite some market commentators warning about bond overvaluation, the fact that pension bond holdings are at historical highs doesn’t seem to evidence it. But, whilst it is encouraging to see heightened cautiousness among pension schemes, greater bond holdings will likely put more pressure on companies to fund pension scheme deficits through cash contributions.

“Some pension schemes’ allocation to equities are surprisingly high, although the information publicly available in their accounts does not reveal the rationale for their investment strategies. Indeed the published reports reveal little detail of the significant activity there has been by many companies and trustees to use LDI (liability-driven investment) strategies to reduce investment risk. However, while it is good to see evidence of pension schemes reducing investment risk, there is still a long way to go before the very significant risks still being run in pension schemes will cease to worry shareholders and pension scheme members alike.

|