The FTSE 100 and their pension disclosures quarterly report estimates that the total deficit in FTSE 100 pension schemes had reached £89 billion at 31 March 2015, a deterioration of £30 billion from 12 months ago. Meanwhile, their total disclosed pension liabilities rose from £557 billion to £615 billion and sponsor contributions fell from £14.6 billion to £13.7 billion.

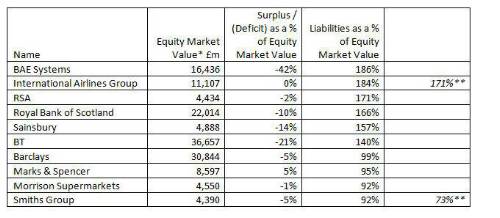

There are a significant number of FTSE 100 companies for which the pension scheme represents a material risk to the business, with six FTSE 100 companies having total disclosed pension liabilities greater than their equity market value. For BAE Systems, International Airlines Group, RSA and Royal Bank of Scotland, total disclosed pension liabilities are almost double their equity market value.

Top 10 FTSE 100 companies with the most significant pension scheme liabilities:

* as at 31 March 2015

** These companies' pension schemes have purchased contracts, which insure part of their liabilities; the figures in italics represent the impact of the liabilities without these insured sections.

Charles Cowling, Director, JLT Employee Benefits, comments:

“The logic for matching assets to liabilities is gradually gaining acceptance among pension schemes and their sponsors, helped by a number of very successful LDI implementations over the last few years, which led to much better outcomes than alternative strategies. Bonds, and LDI strategies in particular, have outperformed equities in the last year or so, which has naturally led to an increase in bond holdings. As LDI becomes more of a norm, so bond allocations will increase. It is possible that average bond holdings could be up to 70% within 5 years, and up to 90% within 10 years.

“Higher bond allocation is also underpinned by the trend in DB scheme closure to new members and new benefits, as this affects trustees’ investment time horizon. We believe that the majority of FTSE100 companies will have ceased all DB pension provision within 12 months - Tesco is just the latest major company to announce the closure of its DB pension scheme. The end of contracting-out next year, recent tax changes and the soaring costs of DB have all accelerated scheme closures and encouraged changes to investment strategies.

“Most companies and pension schemes wish to reduce investment risk (i.e. switch to bonds) more than they have, particularly in light of the Pensions Regulator’s heightened focus on integrated funding, investment, and employer covenant, risk strategies.

Often, the only thing that stops them is a large deficit and/or a lack of funding commitment, which spurs them to keep investment risk in the hope for higher returns. As and when deficits eventually reduce, the barriers to switching into bonds will largely disappear.”

|