|

|

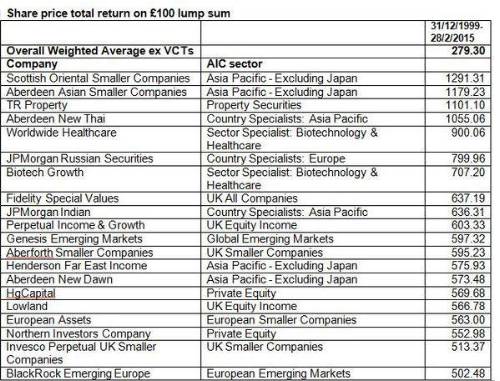

The FTSE 100 has again hit an all-time high, breaking 7000 for the first time. With investment company performance linked so closely to stock market activity, how has the closed-ended sector performed since the record high in 1999? The Association of Investment Companies (AIC) has taken a look at the twenty top performing investment companies from the previous all-time high to the end of February 2015 (see table). |

Top performance from Asia Pacific

Sectors focused on the Asia Pacific region account for 30% (six of the twenty) highest performing investment companies. The top performing investment company between 31st December 1999 and 28th February 2015 was Scottish Oriental Smaller Companies, from the Asia Pacific – Excluding Japan sector, up an impressive 1191% over the 15 years and 2 months since the last FTSE 100 record high. Aberdeen Asian Smaller Companies, from the same sector, was the next highest performer, up 1079%. Aberdeen New Thai, from the Country Specialists: Asia Pacific sector was the fourth highest performer, up 955%.

Geography matters

Geographically focused sectors account for 75% of the 20 highest performing investment companies in this period. In the UK, Fidelity Special Values, from the UK All Companies sector, was up 537%, and Perpetual Income & Growth (UK Equity Income) was up 503%. Outside of the Asia Pacific, European Assets (European Smaller Companies) was up 463%. JPMorgan Russian Securities (Country Specialists: Europe) was up 700%, but has seen difficult conditions recently.

Specialist sectors

The 1999 FTSE 100 all-time high was preceded by the dotcom bubble, but other specialist sectors have featured between 31st December 1999 and 28th February 2015. The Sector Specialist: Biotechnology & Healthcare sector features twice in the top twenty highest performing investment companies during this period, with Worldwide Healthcare up 800% and Biotech Growth up 607%. TR Property, from the Property Securities sector, was the third highest performer overall, up 1001%.

Annabel Brodie-Smith, Communications Director, AIC, said:

“Over the last fifteen years, we’ve seen bull markets, bear markets and a serious recession. Despite all this, investment companies have ridden out the highs and lows of the stock market and delivered impressive returns over this fifteen year period.”

Share price total return on £100 lump sum

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.