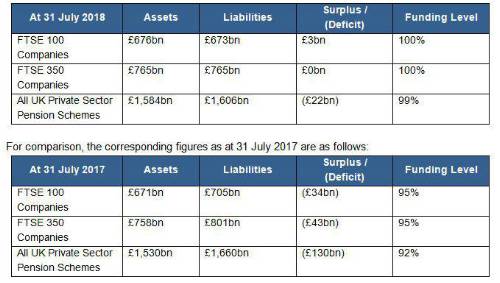

As at 31 July 2018, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Chief Actuary, JLT Employee Benefits, comments: “After 10 years of deficits, finance directors may be celebrating today as FTSE 100 pension schemes finally move into surplus. Of course, this is the overall picture and individual companies and their pension schemes may show different positions. Equally, in many cases, these accounting numbers are not the same figures that pension scheme trustees will be looking at when making demands on employers for pension scheme funding. Trustees tend to be a lot more cautious when looking at their pension scheme valuations and may therefore still be making requests on employers for additional funding of pension deficits.

“That said, the latest move is still good news for all UK pension schemes. Despite an unsettled political backdrop, with Brexit looming, markets have continued to be favourable for pension schemes. Moreover, the improvements in life expectancy, which have added so much to pension scheme liabilities over the last 10 or 20 years, do indeed seem to be slowing.

“Much may depend on Thursday’s meeting of the Monetary Policy Committee at the Bank of England, with City experts and pundits alike widely predicting an interest rate rise. If Bank base rates increase to 0.75% as expected, it will only be the second time since the 2008 financial crisis that the Bank has increased rates. Pension schemes have been hoping to see interest rate rises for most of the last 10 years. The record low interest rates through this period have been a key driver in producing huge pension scheme deficits, which are only just now reaching recovery as a result of the long bull market in equities.

“In combination, these factors may present an ideal opportunity for pension schemes to lock in their position and switch out of risky assets into investments that more closely match their liabilities. Having spent 10 years clawing their way back into surplus, it would be a very sad day for pension schemes if all that progress was lost in another crisis of confidence in markets.

“Indeed, finance directors and trustees alike should be actively assessing the many favourable opportunities now available to lock in their liabilities. This can be either through the purchase of matching cash-flow driven investments (CDI), of which there are a growing number of options now available, or through the purchase of annuities, where insurance company pricing continues to be favourable and 2018 looks set to be another bumper year for insurance company transactions.”

|