In March 2020, The Pensions Regulator (TPR) reacted quickly to the announcement of the first UK lockdown, releasing guidance to help trustees react to the challenges brought about by Covid-19. A key issue was dealing with requests by companies to temporarily suspend DB pension scheme contributions, in a bid to manage liquidity pressures and preserve cash reserves.

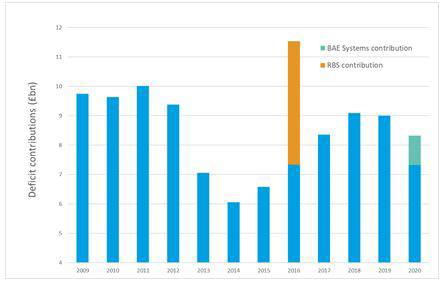

Deficit contribution levels fell slightly over the year (by around 7% in aggregate), suggesting the impact of Covid-19 on overall contribution levels was limited. However, the data is slightly skewed by the large one-off £1 billion contribution paid by BAE Systems plc over the period. Once this is excluded from the analysis, overall deficit contributions into the FTSE350 DB schemes fell by around £1.6 billion over the year (a fall of around 18% in aggregate), indicating a more substantial impact.

But delving into the detail, less than a third of this £1.6 billion reduction was a result of Covid-19 deferrals, with the main reason for contribution reductions being changes to recovery plans as scheme funding levels improved in the period prior to the pandemic.

And in terms of solvency, FTSE350 DB schemes benefited from the astonishing resurgence in financial markets. By the end of May 2021, equity markets were up by over 20% compared to the same point last year, with the news of the vaccine in November providing the key turning point. Over the same period, index-linked bond yields were up by around 25 basis points, reducing the value of DB scheme liabilities.

The impact of these financial market changes means that the aggregate buyout deficit of the FTSE350 DB schemes now stands at £130bn, a reduction of £80bn since the end of May last year.

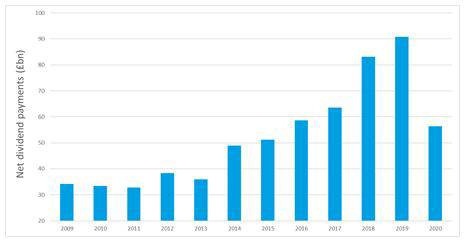

Deficits versus Dividends

The treatment of DB pension schemes relative to company shareholders is an issue frequently raised by TPR, and is often illustrated by the level of deficit contributions versus the level of dividends paid. Dividends to shareholders reduced by around 38% over the year, a drop of around £34bn. As such, shareholders arguably bore a greater portion of the pain than DB schemes during the initial economic crisis.

Endgame awaits

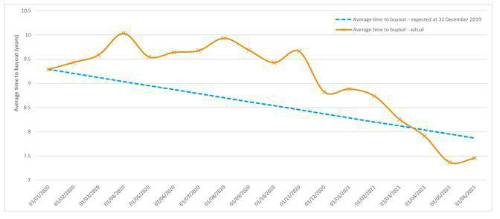

The strong recovery in financial markets means that the FTSE350 DB schemes’ journey to the endgame is now firmly back on course. At the end of December 2019, the average time to buyout for the FTSE350 DB schemes was around 9 years and 3 months.

Despite the significant volatility over the year, the chart shows that the FTSE350 DB schemes are now ahead of the expectations prior to the economic disruption of Covid-19, with the average time to buyout standing at around 7 years and 5 months at the end of May 2021.

Assuming the deficit contributions paid over 2020 continue, Barnett Waddingham predicts that around 61% of the FTSE350 DB schemes can expect to be in a position to buyout within 10 years.

Average time to buyout for FTSE350 DB schemes since 31 December 2019

Simon Taylor, Partner at Barnett Waddingham, said: “The Covid-19 crisis caused severe disruption across the world economy, and the UK’s pension landscape was no exception. However, it seems that the worst has passed, and the winds of change are blowing in a more optimistic direction. C-suites and trustee boards alike will be breathing a sigh of relief that the Covid-19 funding gap appears to have been resolved without the need for a significant cash outlay.

“But we must not rest on our laurels. There will undoubtedly be more challenging times ahead for DB schemes. If the past year and a half has proved anything, it is that a journey plan is the strongest tool in any strategic leader’s arsenal, and that is especially true for those managing a DB scheme. Being clear what a scheme’s objective is and agreeing a plan with clear risk parameters helps to put significant financial market changes into context. Having a clear decision-making framework also allows action to be taken quickly where necessary, and to capitalise on any opportunities that might arise. The material improvement in funding positions over the last few months is a good example of how journey plans can add significant value. A robust real-time monitoring framework will have identified this step change in funding levels, allowing companies and trustees to take action to reduce risk and lock in the positive investment returns experienced over recent months.”

For trustees and companies mapping the course of their DB pension schemes, Barnett Waddingham has launched a DB Navigator to offer a clear and simple decision-making framework to support on the journey.

|