Other key takeaways include:

• Equity strategies have reported net redemptions on aggregate since November 2022 and outflows from the UK equity categories continued, extending their recent negative trend.

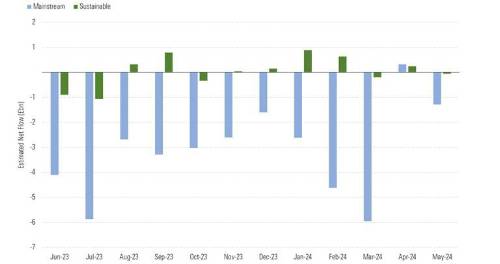

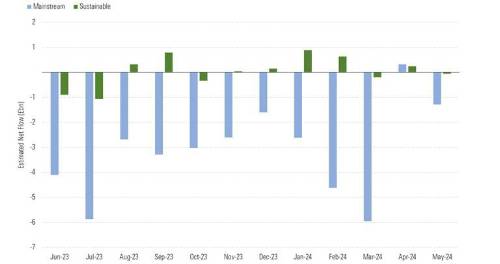

• Sustainably-labeled funds suffered less outflows than their mainstream counterparts.

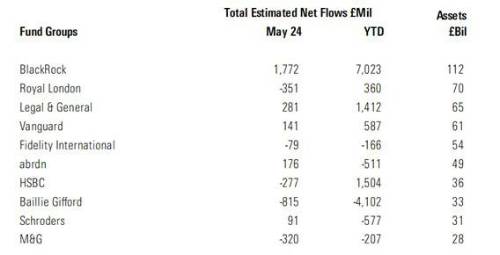

• BlackRock saw the biggest inflows in May and is well ahead of peers for the year to date.

• Investors’ appetite for money market strategies offset outflows in May.

• Passive strategies recorded net inflows, while active strategies saw further redemptions in May.

• Investors showed a preference for Global Large-Cap Equity strategies on aggregate.

• Newly launched JPM Global Focus, the UK-domiciled version of its longer-standing SICAV, was met with strong investor demand and topped the flows league table in May.

Sustainable Versus Mainstream Flows

Sustainably labeled funds suffered less outflows than their mainstream counterparts in May.

Giovanni Cafaro, analyst, Morningstar Manager Research and author of the report commented:

Giovanni Cafaro, analyst, Morningstar Manager Research and author of the report commented: “The UK fund universe in May saw a continuation of trends across different asset classes.?UK equity strategies continued to face outflows of £2.4bn on aggregate, contributing to year-to-date redemptions surpassing £10bn. In contrast, global large-cap equities saw significant investor interest, attracting £1.4bn in May and £3.3bn so far this year. Meanwhile, flow data across fixed-income markets showed a continued preference for global corporate bond strategies, albeit offset by combined outflows amounting to £528m from GBP corporate bond and global flexible bond funds during the month.”

“The overarching trend of investors’ preference for passive offerings has also continued. This has been a tailwind for fund houses offering passive products, including BlackRock which saw a further £1.7bn of inflows in May, totaling £7bn for the year-to-date.”

Estimated Net Flows for the Top 10 Fund Groups (Only UK-Domiciled Funds) by Assets (GBP Millions)

BlackRock saw the biggest inflows in May and is well ahead of peers for the year to date. Overall, great investor appetite for passive strategies has proved to be a tailwind for fund groups with good passive offerings.

|