• More than two-fifths of pension savers aged 45-plus have not planned for the impact of financial and family shocks in retirement but 85% are worried about them

• Nearly one in three fear making mistakes with their pension but ill-health in retirement is their biggest concern

• MetLIfe launches new Retirement Portfolio offering certainty, flexibility and value for retirement savers

Its study of the hopes and fears of the UK’s 15.8 million over-45s – who MetLife call the Exposed Generation, as they are coping with new pension rules as well as family and financial pressures - shows 85% are worried about the increased risks to retirement dreams now that pension freedoms are available.

Nearly a third (31%) fear the impact of making mistakes with retirement savings but the biggest concern for 45% of over-45s is being able to afford long-term care if they or their partner suffer ill-health in retirement.

The study shows a gender split – nearly half (49%) of women say they have not planned for potential future shocks compared to 36% of men while just 27% of men are worried about making mistakes with retirement savings compared with 35%.

MetLife conducted the study as it believes the over-45s have the most to gain – and potentially lose – from pension freedoms and has launched its new Retirement Portfolio flexible guaranteed drawdown plan which is the first to provide daily lock-ins and enables savers to start, stop and restart their income** in retirement to suit their personal needs.

The research shows the Exposed Generation expect to have on average retirement savings of £125,570 by the time they stop work and hope to have an average retirement income of £21,700. But more than 2.5 million – 16% of over-45s – have no private pension savings.

Dominic Grinstead, Managing Director, MetLife UK said: “There is a real risk that the rush to take advantage of pension freedoms could leave savers facing real hardship in retirement if they are not prepared for financial and life shocks. All savers and those who are already retired are hugely vulnerable to future shocks and the research shows the over-45s are well aware of the risks but are not taking action to prepare.

“Future shocks range from the financial such as a stock market crash hitting savings to a surge in inflation hitting income to the general risks of life such as house repairs, paying for long-term care or having to bail out adult children.

“Retirement income plans have to be flexible enough to accommodate these financial and life issues while also providing certainty and good value which is why we have launched our new Retirement Portfolio specifically in response to customer need in the new retirement landscape.”

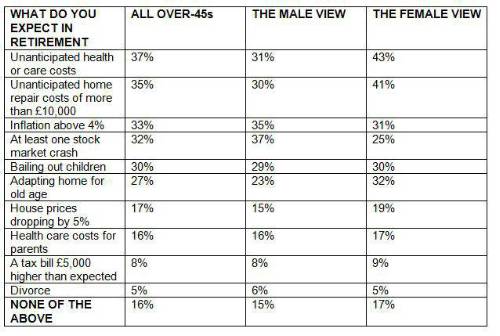

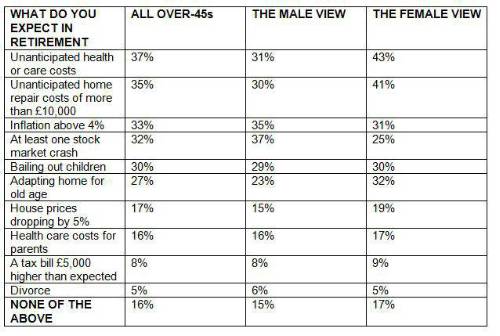

The table below shows the future shocks the over-45s expect to face in retirement and the difference in views between men and women. Around one in 20 expect they might end up divorced.

|