Retirees choosing to buy annuities later in life are most at risk of missing out on extra lifetime income by failing to shop around, new analysis of market data by retirement specialist Just Group shows.

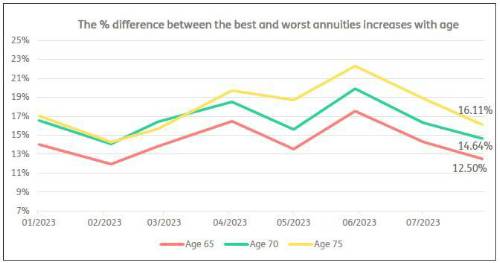

Choosing the most competitive annuity provider over the least competitive can result in thousands of pounds of extra income over the course of a long retirement. But research into recent rates shows the gap between the best and worst deals is much higher at age 75 than at age 65.

A healthy 75-year-old can currently secure about 16% more income from the best provider compared to the worst. The gap is narrower at age 70 (15%) and at age 65 (13%).

Stephen Lowe, group communications director at Just Group, said that the figures reinforce the need to shop around at all ages, but that older buyers are most at risk of poor outcomes, especially given the ‘best-worst’ gap at age 75 has been as high as 22% in recent months.

“Better rates are pushing up interest in annuities but buyers must still do their homework in order to avoid the worst providers and secure the highest possible guaranteed income for life.”

In cash terms, a healthy 75-year-old buying an annuity with a £50,000 pension could expect about £4,720 income each year for the rest of their life from the most competitive provider compared to £4,070 from the least competitive, a difference of £650 (16%) every year.The best-worst difference is £500 a year at age 70 and £400 at age 65.

“The certainty of annuity income makes it relatively more attractive with age as people seek to reduce the risk of outliving their assets,” said Stephen Lowe. “For those who can afford to, deferring annuitisation or buying annuities in tranches can work well.

“But it still depends on getting the best deal when you do decide to buy and not just accepting the first offer.

“That means disclosing health and lifestyle information to get a personalised rate. Then taking that information into the open market to see which providers are the most competitive. The better the deal the more income you will enjoy for the rest of your life.”

He recommends all retirees should take the free, independent and impartial guidance from the government-backed Pension Wise service. Professional annuity brokers or financial advisers can help choose options and compare between providers.

“It’s quite shocking that the FCA found half of annuity buyers did not compare rates to find the best provider – it’s the closest thing in the financial world to being given ‘free money’ and it raises concerns about the level of support retirees are receiving,” he said.

“There are no second chances when you buy an annuity. It’s important to do it right first time.”

|