The average home insurance premium has dropped to £177 in Q1 2021 (January 2021 – March 2021) – a £2 decrease from the previous quarter and a slight increase compared to the same period last year (January 2020 – March 2020), when average premiums were around £174. Home insurance premiums have been steadily creeping up over last few years though, as the average premium in Q1 2018 was £158.

However, the gap between the average and cheapest premiums has widened quarter-on-quarter, which suggests there is more competition in the market as providers compete for new customers with lower offers. In Q1 2021, the cheapest premium typically available was £86, falling from £103 in Q4 2020 (October – December 2020).

Analysis from comparethemarket.com shows that this quarter, the cheapest premium available plummeted to £78 in March 2021, down from £101 in January 2021 – a decrease of 29%. The sudden drop could mean the cost of premiums remains at this level as the pressure among insurers to attract new customers is likely to continue. This means that there are significant savings available to those who shop around for the best deal when their policy comes to an end.

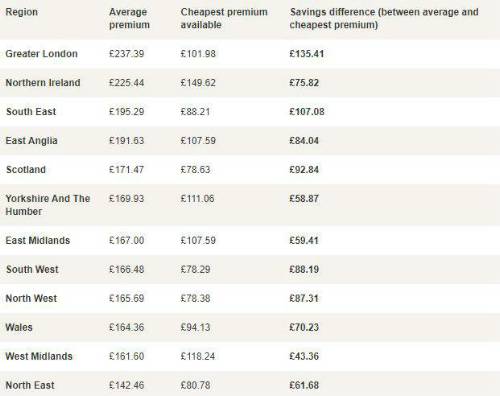

London sees highest home insurance premiums

Broken down by region, London has the highest average home insurance premiums, at £237, whereas the North East has the lowest average premium at £142. London is also where the highest amount of savings can be made by switching, with a difference in premiums of £135.

Property type impacts premiums

In the last quarter, mid-terraced bungalows typically had the lowest average premiums at £99, compared to an end of terrace townhouse which costs an average of £169 to insure, and a detached house with an annual premium of £234. The difference between types of flats was minimal, with the average policy for a top-floor flat costing £109, compared with £115 for a ground-floor flat.

Chris King, Head of Home Insurance at comparethemarket.com, said: “These findings show that loyalty doesn’t pay. Switching providers remains one of the most effective ways to save money – and it can be done more easily and quickly than most people think.

“Household budgets have been squeezed over the last year and many have been looking to save money on their bills by shopping around for better deals. There are certainly savings available for home insurance, as insurers compete to attract new customers.

The difference between the average and the lowest price available increased by a fifth last quarter, meaning the savings available are even greater at the moment, but only to those who look for them.”

|