The fifth data release in a new research series focused on Generation X from retirement specialist Just Group unearths the financial responsibilities troubling people born between 1965-1980, creating Generation Anxiety.

Previous research from this Generation Anxiety series has demonstrated how: many in this group expect to work beyond State Pension Age; are worried about the adequacy of their pension savings; whether they will pay off their mortgage before retirement; and a significant proportion acting as the Bank of Mum and Dad for the daily living costs of their adult children.

This latest data release from Just Group sheds light on the contribution Gen X is making towards the care of elderly relatives – creating a significant financial and emotional burden on this generation.

The data revealed that over one in 10 (11%) of Generation X are chipping in to provide financial support for the care of their elderly relatives; covering the costs of things like contributions to care home fees, visits from a home carer, weekly shopping or funding home improvements.

Those providing support estimated that they were spending an average of £237.50 a week – or £12,350 a year, around £800 more than the full new State Pension will be worth from April 2024 (£11,542).

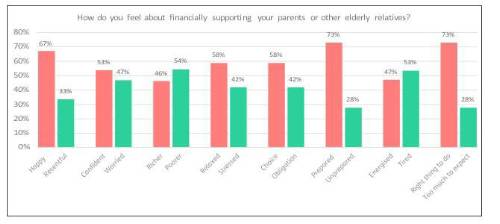

Asked how they felt about contributing to their parents or relatives’ care costs, the majority answered that they felt poorer (54%) and more tired (53%) as a result. A further four in 10 felt unprepared (39%) and a similar proportion were stressed (42%).

Stephen Lowe, group communications director at retirement specialist Just Group, said the data accentuates the financial demands placed on this group: “When elderly parents or loved ones begin to need formal caring arrangements, it can be a difficult and emotional time.

“It is little surprise that Generation X feel that contributing financially to their parents or elderly relatives care is the right thing to do but it is clear that, for many, the cost of this additional support is adding to the already significant pressures squeezing this generation.

“The costs of contributing towards the care of elderly family members are not trivial – either in financial or emotional terms. Generation X is spending, on average, the equivalent of more than a full State Pension every year to provide this financial support.

“The money they are spending is unlikely to be surplus to requirements and there will be competing demands from saving into their pension pots to paying off their mortgage, from helping their children to supporting their elderly parents. It’s no wonder many seem resigned to working beyond the State Pension Age.”

|