Nearly half of Gen Z say they plan to move to part time work (47%) as they approach retirement while almost a quarter think they’ll move to be self-employed and set up their own business (22%)

However, 76% of current retirees stopped working altogether rather than taking a phased approach

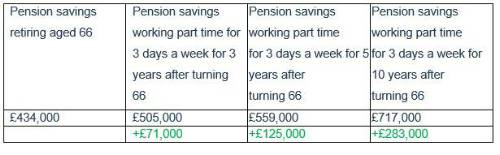

Standard Life analysis highlights how working part time for 3 days a week for 3 years could result in £71k more in your pension pot

It might be a long way off for them but Gen Z intend to work part time or even set up their own business once they reach retirement age instead of stopping work altogether, new research from Standard Life, part of Phoenix Group, finds. Its analysis also highlights how continuing to work part time for just a few years could significantly boost pension pots.

47% of Gen Z said they would like to work-part time in the run up to retirement while 22% said they hope to move into self-employment or start a business. The trend towards longer-lives and the move away from a job for life may well mean that many end up doing so.

However, more than three quarters (76%) of current retirees stopped working entirely when they began their retirement rather than phasing into it. Meanwhile, less than one in five (17%) moved to part time work, and just 3% set up their own business before fully retiring.

Dean Butler, Managing Director for Retail at Standard Life said: “Younger generations are looking at retirement in a very different way and see it as more of a phased run-in to eventually stopping work. While their attitudes may change over time, this pattern makes a lot of sense given longer lives and changes in working habits. It does of course come with its own challenges and relies both on people finding the right employment opportunities and being in good enough health to take advantage of them.”

Part time work post-retirement age can provide a significant uplift to your pension pot

As younger generations plan for a more phased approach into their retirement, Standard Life analysis highlights how reducing working hours for a few years once reaching retirement age could significantly boost total pension pots.

For example, someone that began working on a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £434,000 by the age of 66.

However, someone that worked part time for 3 days a week for 3 years beyond retirement age could find themselves £71,000 better off in retirement assuming they leave their pension untouched. Of course, those in a position to continue working part time for longer beyond retirement age have the potential to amass a larger retirement fund. These figures are not adjusted for inflation.

*if beginning working with a salary of £25,000 per year and paying 5% monthly employee contributions and 3% employer contributions into a workplace pension at the age of 22 and assuming 3.5% salary growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 1.00% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Dean Butler, Managing Director for Retail at Standard Life said: “As the figures show, if you’re able to continue working and not touch your pension for a number of years the effects of further contributions and compound investment growth can really add up. It’s relatively common now for people to access other forms of savings such as ISAs before touching their pensions and while that won’t be practical for everyone, these tops up as people phase into retirement could really boost their pensions.”

|