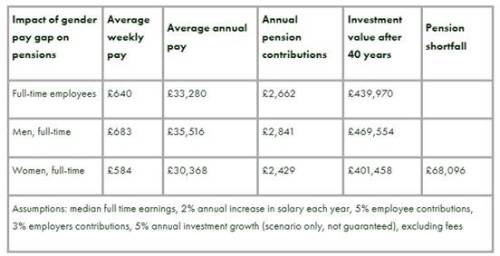

Based on comparisons between men and women earning full time salaries and in median terms, Alice Guy calculates that the female pension shortfall at retirement is £68,096 (see tables below), although charges have been excluded, because they can vary enormously.

In reality the difference will often be larger because women are much more likely to take time out from the workplace to raise a family or due to caring responsibilities.

Given the well document pension and investment gap, it is thought provoking that to date, 64% of people who have been referred to interactive investor via its Friends and Family* scheme have been female. And of those referring Friends and Family members, some 85% have been male. Overall, around a third of interactive investor’s customers are female, so this is an interesting emerging trend.

Gaping Pension shortfall

Alice Guy, Head of Pensions and Savings, interactive investor, says: “Being paid less than a man is appalling, and looking at median monthly earnings, the average gender pay gap is around £5,000 for full time employees and that has a knock-effect when it comes to retirement. A woman on the average full-time salary who saves into her pension for 40 years could have £68,096 less in her pension than a man who earns the average salary (assuming 5% employee and 3% employer pension contributions).

“It’s important for couples to look under the bonnet of their pensions and think about how fund their retirement. Many annuities, for example don’t pay out once the first partner dies, which can be a huge issue for women who are relying on their partner’s income in retirement.

“The new state pension also doesn’t pay out anything to a surviving spouse so men and women will each need to build up their own state pension entitlement.

“If you can afford it, then topping up your pension contributions can make sense. The government automatically tops up pension contributions by 20%, so it will only cost £80 to pay £100 into your pension. Higher rate taxpayers get an even better deal and it only costs £60 to pay in £100.”

https://commonslibrary.parliament.uk/research-briefings/cbp-8456/

Male versus female performance

A gender pay and pension gap there unquestionably is. When women do invest, they run their money along very similar lines to men.

Interactive investor’s Q4 2022 private investor performance index shows similar levels of cash, similar direct equity exposure (albeit with a slightly higher exposure to the UK for women). Fund exposure is the same, although women have significantly higher exposure to investment trusts than men, at 24%, compared to men with 19% on average.

Looking at ii’s last quarterly Private Investor Performance Index, we can also see that female customers to date have outperformed men over the last three years (since we started publishing our index), to 31 December 2022. The average female customer outperformed the average male customer over those three years by almost 1 percentage point (up 5.96%, versus 4.79% for men). Over one year to end December 222, ii’s female customers were down -8% compared to -9.2% for men.

|