Analysis from independent financial services consultancy Broadstone highlights a persistent pension gender gap with a notably smaller proportion of women contributing to their occupational Defined Contribution (DC) pension. This trend inevitably has led to women holding significantly smaller median occupational DC pensions leading to fears of inadequate incomes in retirement.

These findings from the Wealth & Assets Survey are based on Occupational DC pensions - workplace pensions provided by employers – and therefore do not reflect contributions to private, personal or Defined Benefit (DB) pensions. However, the findings still highlight broader structural issues that are contributing to pension inequality in the workplace.

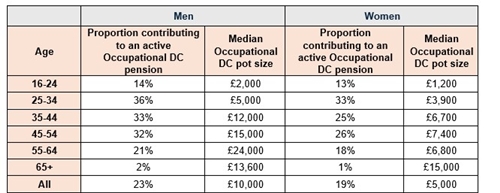

Broadstone’s analysis found that across all age groups, 23% of men aged 16 and above are actively contributing to their Occupational DC pension and have a median Occupational DC pension pot size of £10,000. In sharp contrast women older than 16 have half the median occupational DC pot size of just £5,000, with a smaller proportion (19%) actively contributing to their scheme. This trend is particularly pronounced for workers in the middle of their career. Only 25% of women aged 35-44 contribute to their workplace DC pension, compared to 33% of men – a difference of eight percentage points. At this age, men have a median occupational DC pot size of £12,000, almost double that of women - £6,700.

Among those aged 45-54, just 25% of women contribute to their occupational DC pensions compared to 32% of men, leaving them with a median pension wealth of £7,400—less than half of men’s £15,000.

Once this gap in pension savings begins to open, it accelerates rapidly. By age 55-64, towards the end of their career, the proportion of men (21%) and women (18%) contributing to their DC pot is relatively similar. However, the gap in median pot size has widened significantly with men having nearly three times the median pot (£24,000) as women in this age group (£6,800).

A key driver of this disparity is career breaks for childcare. Research2 from the Pensions Policy Institute (PPI) highlights differing working patterns as the biggest factor behind the gender pension gap. Women are more likely to take time off or work part-time where hourly pay is often lower, reducing their pension contributions and damaging career progression to higher-paid roles later in their careers.

The PPI estimates these career patterns alone cut women’s pension wealth by 47%, with the biggest impact occurring in their 30s – when many step back from work to care for children or family – as reflected in the Wealth & Assets Survey data.

Rachel Coles, Workplace Engagement Consultant at Broadstone, said: “Our analysis highlights a stark gender difference in participation to active occupational DC pensions between men and women, driving a widening gap in total savings. The findings reflect a well-documented trend of women, on average, entering retirement with less wealth with factors such as childbirth and menopause forcing many out of the labour market or into part-time work and inhibiting future career progression. Employers can play an important role by offering greater flexibility around pension contributions during career breaks, for example, while olicymakers should explore solutions such as enhanced parental leave policies and better support for returners to the workforce. It’s also vital that women have access to tailored financial advice and planning tools to navigate career gaps and understand the importance of early saving in improving retirement outcomes. Employers can support this by offering financial education that helps female employees plan for any career breaks and take proactive steps to close any savings gaps.”

|