The fourth data release in a new research series focused on Generation X from retirement specialist Just Group digs into the financial demands from family placed on Generation X parents (born between 1965-1980) and how it’s creating Generation Anxiety.

This data reveals that many adult children are drawing on the ‘Bank of Mum and Dad’ with a third (29%) of Generation X parents stating that they still financially support their adult children, aged 21 and older.

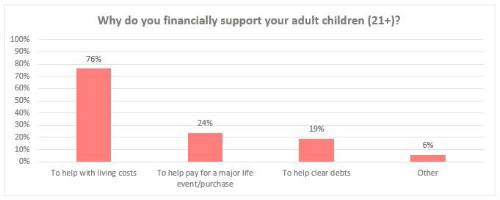

The Bank of Mum and Dad has typically been associated with major purchases or life events like house deposits or weddings. This research, however, shows everyday living costs are the main reason Generation X parents are supporting adult children, indicating that the cost of living crisis alongside student debts, sky-high rental and house prices have refocused financial priorities.

When asked why they were financially supporting their adult children, more than three-quarters of Generation X parents (76%) said they were providing ongoing help to cover living expenses. Nearly a fifth (19%) said that it was to help adult children clear their debts. A quarter (24%) of respondents said they contributed financially towards a major life event, like a wedding or house purchase, and 6% said there was another reason for the financial support.

Generation X parents have mixed feelings about acting as the Bank of Mum and Dad for their grown up children. Nine in ten (87%) said they were happy to offer the financial support but more than two-thirds (65%) said they feel poorer for it and nearly half (46%) said they felt worried.

Stephen Lowe, group communications director at retirement specialist Just Group, said the data tells a tale of Generation X feeling the squeeze.

“It’s hard to say no to family, especially when it comes to money, but our research lays bare the pressure placed on Generation X by financially supporting their children,” said Stephen Lowe.

“In the past children may have tapped the Bank of Mum and Dad for big ticket life events, such as weddings or to help with a deposit to get onto the housing ladder. Today things look very different and parents are far more likely to be providing cash to help with day-to-day living expenses.

“Meeting these financial demands from family may feel like the right thing to do but for many it means less money for their own retirement fund or mortgage payments.

“It’s no wonder many in this age group expect to work beyond State Pension Age, are worried about the adequacy of their pension savings and are unsure if they will be able to pay off their mortgage by the time they retire. Less Generation X and more Generation Anxiety.”

|