Here are three insane strategies for writing fleet business, guaranteed to lose money. Here are three insane strategies for writing fleet business, guaranteed to lose money.

• The counter-cyclical strategy: Shortly after losing money at the bottom of the cycle, exit the market because you consider it too volatile and there is too much capacity competing for the same business. Be sure to irritate brokers and customers. Miss the five years when the market is reasonably profitable. Then decide that you need to seriously grow your premium income and re-enter the market when rates are again at an all time low. Hire underwriters to write lots of underpriced business.

• The aggressive strategy with blindfold: Start up your operation at any point in the cycle – even a good part but be sure to write underpriced and / or poor quality risks. As poor results start to emerge, blindfold yourself and persuade yourself that you are better than everyone else and therefore things will improve. (Example reason: Your risk management is better than anyone else’s). When things finally catch up with you, downsize and then close altogether.

• The crooked strategy: Write underpriced and risky business and also hire Directors who are happy to fiddle claims reserves. Report amazing results. Stand back and wait for the explosion.

These strategies have been tried successfully over the past 10 or so years and do indeed work spectacularly well. They are indeed guaranteed to lose money.

But why do people try them? Aren’t we in business to make money for our shareholders?

I’m sure you have your own views of why senior managers within the insurance industry seem to outsiders to be hell-bent on destroying value. An underwriter recently suggested to me that this is simply driven by inflated egos. I think though that part of it is simply desperation – they know of no other way to try to protect the top line and at the same time produce at least a small profit.

The good news is that two ideas – credibility and the Venn diagram – can help us make money in this market. Without the ego. And without the desperation.

We introduced credibility last month. The credibility idea is still underutilised in the fleet market. Some players do not use it at all and of those who do, not all have optimised its use. It is an old and well tested idea. So it is easy to find out how to apply it. One place to look is at the statistical ideas used for experiments carried out in the farming industry - in particular the concept of “random effects”. Imagine you are a farmer. Your grow oats and would like to maximise the yield. The weather sadly is not under your power. But you can choose the variety and the type of fertiliser. You are going to test three types of fertiliser on four varieties of oats. In order to be sure that the result is not driven by features of the field that you use for the experiment, you decide to repeat the trial in eight separate fields. When you get the results, you find that as expected they vary with variety of oats and type of fertiliser. However you also find that they vary between the eight fields. You have no idea what factor is driving the variation between fields. It could well be that had you chosen another eight fields, that the results would have been different in some other way, and indeed when you sow all of your other fields next year the results could be different yet again. The differences between fields appear to you to be random – yet you need to analyse this randomness somehow so that you can make an informed choice for next year.

Fleet insurance is the same. After allowing for all known features of the fleets (possibly not including fertiliser or oats), there are still some random looking differences between fleets and you need somehow to understand the randomness so that you can make an informed pricing decision for next year.

Every actuary is trained in credibility. Every statistician is trained in random effects models. (And vice versa. Hopefully.) No excuse for any delays in implementing or improving application of these ideas in your fleet pricing.

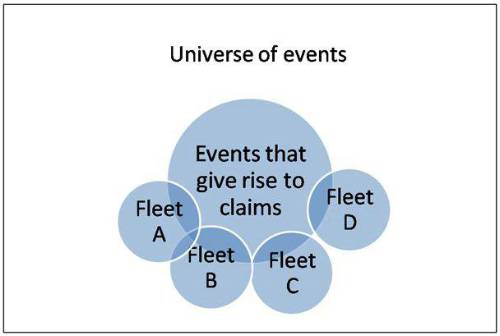

Finally we can move on to Venn diagrams (see Figure 1 below) – what I’ve referred to previously as the bigger picture.

Figure 1: When we price, we consider the events that may give rise to claims and model them. Different fleets are impacted by different events. We can use credibility to price accurately. But what if we have not considered all possible events?

The starting point of all pricing – whether we realise it or not – is an assumption about which events may happen and whether these will affect the frequency, severity or timing of claims.

Over the past twenty years, many events have happened that were outside of the universe that we had previously experienced or expected. The introduction of the Ogden tables and the repeated lowering of the interest rates.

Whiplash. Fraud. Credit repairers and credit hire. Accident management companies.

Credibility helps us to measure accurately events that are within our universe. What can we do regarding events outside of our universe? Exactly the opposite of what many companies do. I’ll write down some of the key steps – leaving you to find the opposites.

• Blindly model the past without really understanding what type of events it includes and therefore what is included and excluded from your model.

• Do not put any kind of monitoring or early warning system in place.

• Ensure that you management structure is unwieldy and inflexible and so unable to react quickly and decisively as crises occur.

• When reserving numbers start to show a trend, ignore the trend on the basis of various “sophisticated” reserving techniques (such as Bornhuetter-Ferguson).

• When you eventually realise that something adverse has happened, ensure to waste months with analysis paralysis – measuring with increasing accuracy the size of the effect – rather than putting practical measures in place to control and mitigate the situation.

• Treat all events as an issue of only one department (reserving, pricing, underwriting, sales etc.) rather than putting together multi-disciplinary teams to deal with all aspects of the situation.

• I am sure there are more points here... feel free to write to me with your own.

This brings us to the end of our foray in to fleet insurance. You can make a profit in this market by doing what insurers are there for. Managing uncertainty. Use the science which is available to do the easy bit – measuring the seeming uncertainty within the box. Optimise your organisation to pro-actively manage uncertainty outside of the box.

Know in advance that you can’t see it all coming. Something will happen.

And when it does. Don’t be afraid to act first.

|