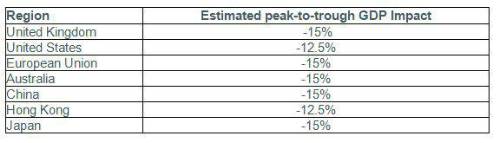

The varying nature of each nation’s service sector and trade balances will likely lead to somewhat different economic outcomes.

However, we expect double-digit declines in GDP peak-to-trough, with the US falling slightly less due to a smaller restaurant sector and trade deficit. Due to unknowns around the duration and effectiveness of containment measures, there is much higher uncertainty to these forecasts than during normal economic times.

Monetary policy will likely be highly accommodative for over 12 months while fiscal policy will need to be loose to ensure firms and individuals have the necessary liquidity to withstand the downturn.

Should authorities be able to contain the virus, this stimulus will likely set the scene for growth to run well-above trend. In most regions, we expect it will take more than 12 months to return to pre-virus levels of activity.”

Insight’s peak-to-trough GDP forecasts

Source: Insight Investment estimates, March 2020.

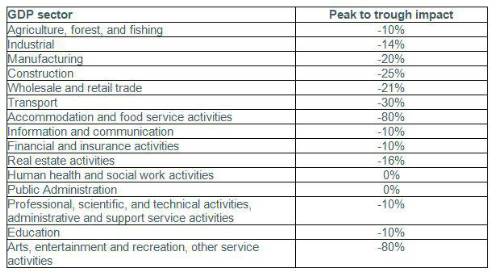

Global travel and leisure sectors could take -80% hits

“We believe sectors tied to travel and leisure will be particularly hard hit. Elsewhere, growing restrictions on nonessential work will likely mean most sectors will face some negative impact, particularly where activity cannot be conducted remotely.

We expect sectors such as construction and manufacturing will face both labour constraints and potential supply chain disruptions, although we believe the impact will be less severe declines than with restaurants, for example.

Our views on the hardest-hit sectors are largely supported by high frequency data. For example, OpenTable suggests that sit-down restaurant activity has fallen by more than 90% in the United States, Germany, and Ireland. It also expects more regions to follow suit.

Similarly, US cinema box office receipts in the week ended March 19 were $58m, the lowest weekly level since at least 1998 and down 70% from the average week in 2019. As more theatres are forced to close worldwide, receipts would be expected to fall further.

At this early stage, we need to emphasise these forecasts have unavoidably wide margins of error as we cannot yet know how successful each nation’s lockdown strategies will be or how long the authorities will pursue them.”

A sector-by-sector impact of the crisis

Source: Insight Investment estimates, March 2020.

|