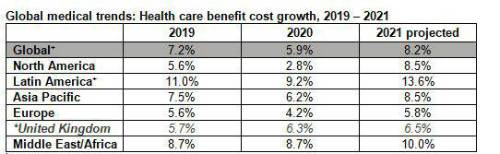

The 2021 Global Medical Trends Survey, the largest of its kind, found medical insurers globally project health care benefit costs will take a sudden drop in 2020 before rebounding to 8.2% in 2021, up from 5.9% this year and 7.2% in. Average increases in the five regions next year will range from 5.8% in Europe to 13.6% in Latin America. Health care benefit cost increases in the U.S. are expected to remain stable at 7.3% next year, according to other Willis Towers Watson research.

In the UK, the cost of private medical insurance continues to edge upward despite the impact of COVID-19, from 5.7% in 2019, to 6.3% in 2020 and an anticipated increase of 6.5% in 2021. Contributing factors include a maturing insured demographic and aging workforce. The report also notes the impact of high-cost treatments, such as new generation cancer drug therapies and wider availability of more complex medical treatments.

The study also found over two-thirds (68%) of respondents expect medical costs will continue to accelerate over the next three years. Nine in ten (89%) Middle East and Africa insurers expect higher medical trends over the next three years followed by insurers in Europe (77%). Only four in ten (39%) Asia Pacific insurers expect higher medical trends.

*Projected

.*UK results also included in average for Europe

+Due to the hyperinflationary nature of the Venezuelan economy, Venezuela has been excluded from Latin America regional and global totals. Including Venezuela, the 2020 global average trends would be 7.2%, and Latin American average trends would be 14.8%.

“The pandemic undoubtedly had a major impact on medical trend this year as it sparked a sharp decline in non-urgent surgeries and elective care,” said Kevin Newman, managing director of Willis Towers Watson’s UK Health & Benefits. “While most countries experienced a decrease in trend this year, that is expected to be short-lived. In fact, we expect to see significant volatility in 2021 results, which are dependent on the impact of COVID-19 and whether or not a vaccine becomes available early in the year, who pays for it and the extent of its availability. In addition, there is uncertainty about how COVID-19 testing and treatment costs for 2021 will continue to be split between government, insurers and employers.”

According to the survey, cancer (79%), cardiovascular diseases (56%), and conditions affecting musculoskeletal and connective tissue (41%) are the top three conditions currently affecting medical costs. But about four in ten predict mental health conditions will be among the three most common conditions affecting costs within the next 18 months (41%), and among the three most expensive in the next 18 months (39%).

When asked for the most significant cost-driving factors outside the control of employers and vendors, just over half of respondents (52%) cited the high cost of medical technology, followed by providers’ profit motives (36%) and epidemics and global pandemics (34%).

“Further uncertainty around medical trend lies ahead as we start to see the true impact of delayed treatment in 2020 and the long-term effects on those who contracted COVID-19. Nevertheless, there is a silver lining as COVID-19 has greatly accelerated the adoption and use of telehealth, which could help to offset those potential higher costs and provide a more efficient way for insureds to access and use healthcare in the future. However, it may also boost utilisation due to ease of access!” said Newman.

|