Falling life premiums in advanced markets such as the US and Western Europe were the main cause of drag on overall global premium growth. Emerging markets, especially China, continued to drive growth. The Swiss Re Institute expects global non-life premiums to rise, led by the US, where the economy is strengthening. It also predicts that global life insurance premiums will improve over the next few years, driven by strong growth in China.

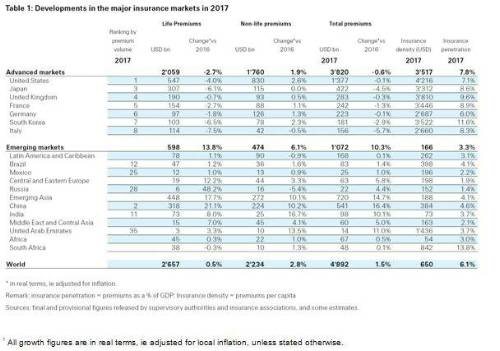

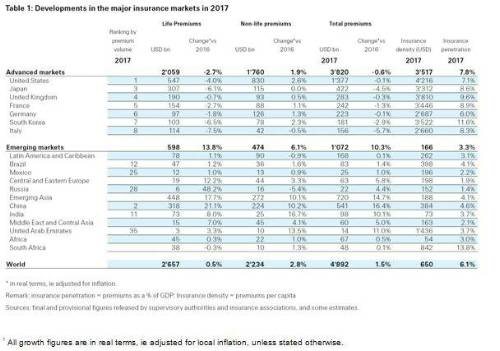

The annually published "world insurance" sigma report on premium volumes and growth trends reveals that the expansion of global premiums has slowed to 1.5% from 2.2% in 2016. Global life premiums increased to roughly USD 2.7 trillion in 2017, while global non-life premiums rose to approximately USD 2.2 trillion. Growth in both the life and non-life sectors slowed.

Falling life premiums in advanced markets such as the US or Western Europe were the main cause of drag on life premium growth.

Slower, but still solid growth in emerging markets led to the slowdown in the non-life sector.

Nevertheless, emerging markets, especially China, remain an important driver of global premium growth. China continued to be among the world's fastest growing insurance markets, particularly in life.

Emerging markets premium growth continues

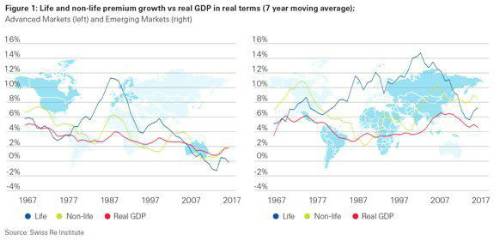

In emerging markets, life and non-life premiums increased 14% and 6.1% respectively in 2017. In the non-life sector, growth in 2017 has slowed but still remained robust. The slowdown in emerging markets was largely driven by China, where the speed of expansion halved to a still solid 10%. The insurance markets in emerging countries have outperformed the corresponding economies for decades, given the current low levels of insurance penetration. In these markets, incomes, revenues and assets of individuals and companies are growing, which in turn boosts the demand for insurance (Figure 1 below, right panel).

China continued to be the main growth engine in emerging markets. Compared to 2016, growth slowed in the region but remained robust. The Chinese life market grew by 21% in 2017, well above its ten year average of 14%. China is now the second largest life market globally after the US and accounts for more than half of emerging market life insurance premiums written, or 11% of the world total.

Premiums in advanced markets face headwinds

Non-life premium growth in advanced markets remained broadly stable in 2017 at 1.9%. In the US, the non-life industry benefitted from higher rates in motor business, while prices in commercial lines remained under pressure.

Life premiums in advanced markets, which fell 2.7% in 2017, were the primary cause of the drag on global growth. The North American life market declined by 3.5%, driven by supply side factors, as players exited the retirement savings business, including variable annuities. Among advanced Asian markets, which were down 2.1%, expectations of lower mortality rates have delayed life insurance purchases in Japan.

The life sector in advanced markets has failed to recover from the 2008 financial crisis. Well documented factors, such as the depressed economic environment, stagnant wages combined with low interest rates and changing solvency regimes made traditional savings products with interest rate guarantees both unattractive for consumers and life insurers (Figure 1 above, left panel).

Analysing 50 years of growth patterns and insurance penetration

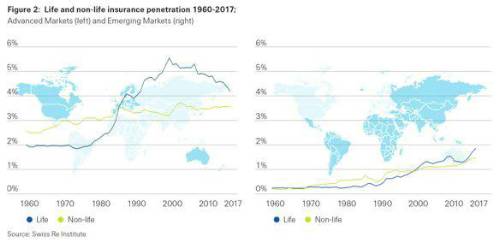

For 50 years, sigma has been publishing data on the global insurance markets showing the changing growth patterns and developments of insurance penetration. Asia has been an important contributor to premium growth on two occasions since 1960. In the late 1970s and early 1980s, life insurance in Japan was in high demand due to the soaring levels of household saving and the country's less developed social security system for old age provision. Since the global financial crisis of 2008/2009, Emerging Asia, led by China, has become the largest source of growth in the global insurance markets, although penetration levels have been gradually increasing across all regions. The regional structure of global insurance markets has shifted from Europe and North America to Advanced and Emerging Asia since 1960.

Jérôme Haegeli, Swiss Re Group Chief Economist, says, "Back then, Advanced and Emerging Asia accounted for 5% of global insurance premiums versus 22% in 2017. For the next decade, the shift to China is likely to continue. Given the impressive number of infrastructure initiatives underway in China, China's contribution to world insurance premiums could yet again exceed expectations. In the following decades, other markets such as India, Indonesia, Brazil, Mexico, Pakistan, Nigeria or Kenya could become more important."

Penetration (premiums/GDP) has increased consistently in emerging economies over time. Meanwhile, non-life penetration has virtually stagnated in the advanced markets since around the turn of the century, while it has been on a declining trend in the life sector of advanced markets (Figure 2).

Market outlook for global life and non-life premiums

Over the next few years, the Swiss Re Institute predicts that global life insurance premiums will rise, driven by strong growth in China. However, profitability continues to be under pressure due to low interest rates, increasing competition and regulatory changes.

Jérôme Haegeli says, "The ongoing low interest rate environment remains a major concern for life insurers' profitability and their ability to offer attractive long term life insurance products, particularly in combination with Solvency II types of regulatory frameworks."

The Swiss Re Institute also expects global non-life premiums to increase, led by advanced markets such as the US, where the economy is strengthening. Although the insurance markets in emerging countries have solidly outperformed the corresponding economies for decades, the Swiss Re Institute estimates that, in the years to come, advanced markets will contribute more than half of the additional premiums in absolute terms.

• Global insurance premiums increased 1.5% to nearly USD 5 trillion in 2017 after rising 2.2% in 2016

• Global life premiums increased 0.5%, global non-life premiums rose 2.8%

• Falling life premiums in advanced markets such as the US or Western Europe main cause of drag on overall global premium growth

• Emerging markets, especially China, continue to be a key driver of global premium growth, particularly in the life sector

• The Swiss Re Institute expects global non-life premiums to improve, led by the US, where the economy is strengthening

• The Swiss Re Institute predicts global life insurance premiums to rise over the next few years, driven by ongoing strong growth in China

• 2018 marks 50th anniversary of sigma publication - sigma has been publishing data on the global insurance markets for the past 50 years

|