The accumulation of economic and insured losses ramped up in the second half of the year, due primarily to the three hurricanes - Harvey, Irma and Maria - that hit the US and the Caribbean, and wildfires in California. Globally, more than 11 000 people have died or gone missing in disaster events in 2017, similar to 2016.

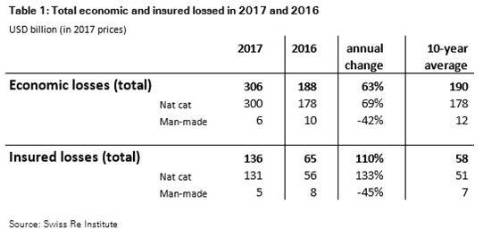

Total economic losses from natural catastrophes and man-made disasters are estimated to be USD 306 billion in 2017, up from USD 188 billion in 2016 and much more than the annual average of the previous 10 years (USD 190 billion). Global insured losses from disaster events in 2017 were around USD 136 billion, up from USD 65 billion in 2016, well above the previous 10-year annual average (USD 58 billion), and the third highest on sigma records. Natural catastrophes accounted for USD 131 billion of this year's insured losses1, and man-made disasters for the remaining USD 5 billion. More than 11 000 people have died or gone missing in catastrophe events, similar to 2016.

"In recent years, annual insurance losses from disaster events have exceeded USD 100 billion a few times", says Martin Bertogg, Head of Catastrophe Perils at Swiss Re. "The insurance industry has demonstrated that it can cope very well with such high losses. However, significant protection gaps remain and if the industry is able to extend its reach, many more people and businesses can become better equipped to withstand the fallout from disaster events."

A year of two halves

Extreme weather in the US in the second half of 2017 has been the main cause of the high number of full-year insured losses. In the first half, the losses resulting from disaster events were lower than in the same period of 2016, and well below the annual six-month average of the previous 10 years.

In August and September, three category 4+ hurricanes – Harvey, Irma, and Maria (HIM) – made landfall in the US. Destruction from the three hurricanes stretched from the Texas coast (Harvey) through West Florida to the Caribbean (Irma and Maria), together causing insured losses estimated to be almost USD 93 billion2 . Given the vast geographic footprint of the hurricanes, which affected multiple locations in quick succession and impacted multiple lines of business, a full assessment of the insured losses is still ongoing. The economic losses from the three events will be much higher given the significant flood damage – often uninsured – from hurricane Harvey in densely populated Houston, Texas, an extended power outage in Puerto Rico after hurricane Maria, and post-event loss amplification.

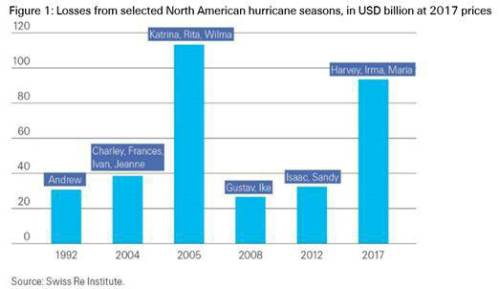

After 12 years with no major hurricane3 making US landfall, HIM have made 2017 the second costliest hurricane season on sigma records after 2005. "There has been a lull in hurricane activity in the US for several years", says Kurt Karl, Swiss Re's Group Chief Economist. "Irrespective, there has been a significant rise in the number of residents and new homes in coastal communities since Katrina, Rita and Wilma in 2005, so when a hurricane strikes, the loss potential in some places is now much higher than it was previously."

Wildfires and thunderstorms add to the losses in the US

Also in the second half of 2017, hot and dry weather in California created favourable conditions for wildfires to ignite and spread to urban areas. There were three major fire events in October in Northern California: Tubbs, Atlas and Mendocino Lake. Both residential and commercial property (including vineyards) were impacted. According to preliminary estimates from Property Claims Services, the major fire events triggered combined insured property losses of USD 7.3 billion. Fires are still raging in Southern California in December, and the as-yet undetermined full-year losses from wildfires will likely be higher.

Other extreme weather in the US led to a high number of severe convective storms (thunderstorms). Five separate severe thunderstorm events from February to June caused insured losses of more than USD 1 billion each. The most intense and costly event was a four-day long storm in May with heavy damage to property inflicted by hail in Colorado and strong winds in other parts of southern and central states. The economic losses of this storm alone were USD 2.8 billion, with insured losses of USD 2.5 billion.

Other regions experience disasters also

In mid-September, two powerful earthquakes in Tehuantepec and Puebla, Mexico, led to numerous building collapses, claiming a large number of victims and resulting in insured losses of more than USD 2 billion. Earlier in the year, in late March, the category 4 tropical Cyclone Debbie hit the northeastern coast of Australia. Wind gusts of up to 263 km/h and widespread flooding in central and southeast Queensland and northeast New South Wales led to insured losses of USD 1.3 billion.

And at the end of April, Europe suffered a cold snap, followed by a summer of heat waves and record temperatures in several locations, making 2017 a year of weather extremes. Further, severe floods in South East Asia caused large devastation and, sadly, a large number or victims.

|