Investors' capital flowed into alternative capital products meaning easily identifiable trigger events such as hurricanes and storms. New catastrophe bond issuance rose from below $1 billion to over $8 billion in the years that followed. The percentage of global reinsurance capital it represented reached double digits 10 years ago.

However, capital is not necessarily going to generate a risk-adjusted return in the reinsurance industry, as global warming leads to economic losses.

Key points to note:

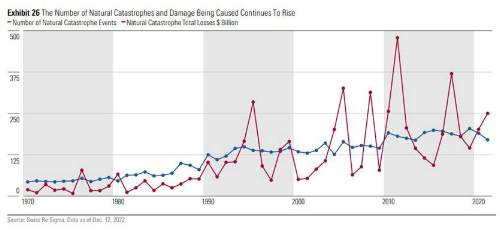

• The 2023 earthquakes in Turkey have been among the most destructive since the start of the 20th Century. Many argue the melting ice caps change the weight distribution across the Earth's crust and this drives changes in plate tectonics and puts a primed fault line at risk. Economic losses from earthquakes have averaged $15 billion over the 10 years prior. These earthquakes are set to cost Turkey $35 billion alone. They remain one of the least well-covered perils in terms of insuring against economic loss. As the number and severity of weather and insured events continues to increase, global construction spending continues to march higher.

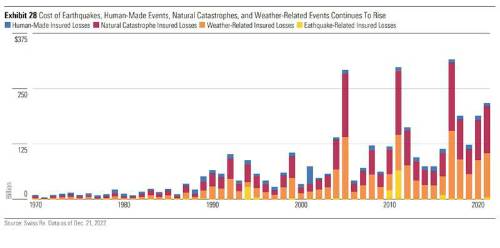

• The U.S. alone spent $21.5 trillion on construction last year. This is staggering considering the $275 billion economic loss from natural catastrophes. While insurers and reinsurers have helped close the protection gap across human-made and weather-related catastrophes over the last 50 years from 4.8 times to 2.3 times, there is a minimum $250 billion protection gap that remains outstanding. At current and reduced capacity, with temperatures and expenditure rising, that protection gap looks set to increase.

• Higher temperatures lead to more evaporation of fresh water and salt water across the planet. This can lead to droughts and famines and increases the frequency and intensity of hurricanes. As sea levels rise and as ice caps melt, coastal storms create more water damage in seaside towns

• As we operate in an increasingly uncertain world where pandemics happen, and global warming, war, and politics have an increasing impact, Morningstar believes the risk of insurable events is set to rise.

Henry Heathfield, Equity Analyst, Morningstar: “Reinsurers have been under pressure over recent years because of the rise of alternative capital and low interest rates that have inflated balance sheets. With rising losses from severe weather events, earnings and balance sheets have declined. Prices have increased because this dynamic has now changed.”

Full report Insurance Observer

|