The figures reflect rising vehicle crime, with Home Office figures recording a 50% rise in vehicle thefts over the last five years. The increase is in part being driven by keyless car crime, with hi-tech criminals being able to bypass keyless technology in as little as 20 seconds.

The ABI’s latest quarterly motor insurance claims report highlights that in the first three months of this year:

16,000 claims for the theft of or from a vehicle were settled by insurers. This was up on the 14,000 for the same period last year, to the highest quarterly figure since 2012. Insurers are now settling a car crime claim every 8 minutes.

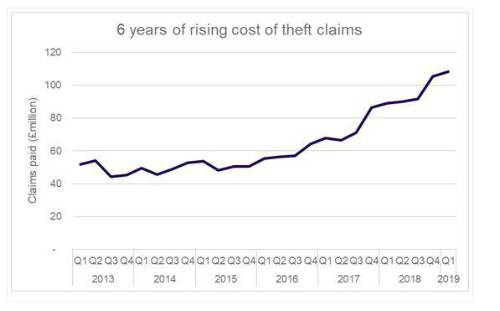

The cost of theft payouts, at £108 million, was up 22% on the same period last year, and works out at over £1.2 million paid to policyholders every day. In the last four years the overall cost of motor theft claims has doubled.

The report also shows that:

The cost of vehicle repairs, to both the vehicles of policyholders and those of third parties during the quarter, was £1.2 billion. This was the highest quarterly figure since the ABI started collecting this data back in 2013. Higher repair bills reflect ever more sophisticated vehicle design and technology, which in most cases costs more to repair when damaged.

For example, the cost of a headlamp for one popular model has risen by over 400% from £163 for the 2012-17 model range to £840 for the most recent model. Average replacement windscreen costs for another popular model have risen from £147 between 2008-9 to £468 for models registered after 2015 3..

Despite the cost pressures from increased theft and more expensive vehicle repairs, the average price paid for motor insurance currently stands at its lowest - £466 2.- in two years. This is likely to reflect some insurers passing on expected cost benefits in anticipation of the introduction of the Civil Liability Act reforms, which will deliver a fairer compensation system for claimants, and continued competitive premiums for motorists. Also, new vehicle registrations in March saw a rise in new cars purchased, typically by more mature, lower risk drivers.

Laurenz Gerger, ABI’s motor insurance policy adviser, said: “The continued growth in car crime must be reversed. Car security has come on leaps and bounds but needs to keep pace with the ingenuity of car criminals. The rising number of theft claims being paid by insurers in part reflects the vulnerability of some cars to keyless relay theft. Action by motor manufacturers to tackle this high-tech vulnerability, allied with owners taking some simple, inexpensive precautions will help put the brakes on this unwelcome trend.”

Keyless car theft explained

Passive keyless entry systems, which allow drivers to open and start their cars without removing the key fob from their pocket, can be exploited using a technique called the ‘Relay Attack.’ Usually operating in pairs, one criminal will hold a device up against the car, to capture the signal it sends out to the key. It then ‘boosts’ this signal to another device by the front wall of the house, which relays the signal to the key inside. This fools the car and key into thinking they are within the 2m range of operation, allowing the car to be unlocked and started. Once started the engine will not restart without the key present.

Recent testing by Thatcham Research. gave 6 of the 11 vehicles launched this year a ‘Poor’ rating as the keyless entry/start system they have as an option has no security measures to prevent theft by criminals using the so-called ‘Relay Attack’ technique.

|