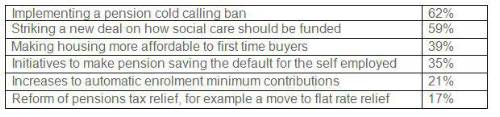

The survey asked financial advisers what areas affecting their clients’ finances the government should be advancing for ‘life after Brexit’. Implementing a ‘cold calling’ ban on pensions was top of the list with 62% of advisers wanting more government focus on pushing through adequate legal protection against the fraudulent activity which can lead to people losing their lifetime savings.

The promised social care government paper, exploring a new deal on how social care will be funded between individuals and the state, was also high on the list with 59% of advisers wanting the government to place greater priority on this. This is not surprising given the latest analysis by Age UK which suggests the number of people who don’t get the care and support they need is at a record high of 1.4 million – an increase of nearly 20% over the last 2 years*.

39% of advisers wanted to see greater government attention on making homes more affordable to first time buyers and 35% would like policy makers to advance pension saving initiatives for self-employed workers, who are currently excluded from auto-enrolment which has successfully brought millions of additional employees into workplace pensions.

Summary of adviser responses on what they would like to see the government advancing with greater priority

Steven Cameron, Pensions Director at Aegon, said: “While Brexit will continue to dominate the government’s time in the months ahead, we can’t allow other policy initiatives which would benefit savers to be pushed back indefinitely. Financial advisers are ideally placed to highlight priorities in areas which will affect their clients’ future financial wellbeing.

“Advisers are clearly very concerned about the risks of individuals being scammed out of their pension savings by ‘cold callers’, and every month of delay risks more people losing their life savings to fraudsters.

“With people on average living longer, more of us will need some form of care in later life and how to share the costs fairly between the government and the individual, is one of our greatest societal challenges. The sooner the government sets out its proposals, the sooner advisers can help their clients plan ahead.

“However, only one in six advisers (17%) support the Government prioritising reforming the tax relief individuals get on their pension contributions. At the moment, people who pay higher rates of income tax get more of a Government top-up than basic rate taxpayers and some have called for everyone to get the same government ‘bonus’. While this might be worth considering longer term, it would be very complex and Aegon agrees that other initiatives should be given higher priority.”

|