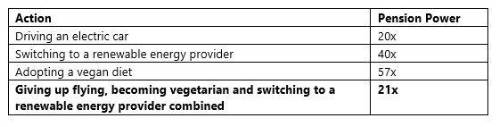

Greening your pension is a staggering 21x more powerful at cutting your carbon footprint than stopping flying, becoming a vegetarian and moving to a renewable energy provider combined.

Those with an average sized pension pot who move from a traditional fund to a sustainable option can expect to save 19 tonnes of carbon a year, while savers with a larger pension of at least £100,000 could save up to 64 tonnes of carbon – that’s nine years’ worth of the UK citizen’s average carbon footprint.

Research further reveals the various impacts that switching the average pension of £30,000 can have when compared to the day-to-day lifestyle changes many of us are making. Moving to a green pension is 57x more effective than switching to a vegan diet – a common choice among climate conscious consumers, and 40x more impactful than moving to a renewable energy provider.

Make My Money Matter believes it is vital that individuals continue to take these steps to reduce their climate impact, but also make sure their money complements those efforts, rather than undermine them.

The research also comes at a time where the financial case for sustainable pensions is also on the rise, with evidence showing that sustainable funds are now matching or outperforming their traditional counterparts.

These findings show that there is an untapped superpower at the disposal of savers across the UK, who can harness their pension as the single most effective tool in the fight against climate change. The campaign is encouraging pension savers to harness this power by contacting their provider and asking them to achieve net zero emissions.

Commenting on the research Richard Curtis, Co-Founder of Make My Money Matter said: “We have taken real collective steps in our society to become greener in our day-to-day lives. However, I helped create Make My Money Matter after being alerted to the fact that our pensions could be undoing all of our hard work without us even knowing. These findings confirm just how important our money is in the fight against climate change. In fact, our pensions are the most powerful weapon we have to help protect the planet.

“We need the entire UK pensions industry to go green – making their default funds more sustainable so all savers can have a pension to be proud of. As individuals, we have a critical role to play in driving this change by showing providers that we want our money invested in a way that does good, not harm and, so that we can retire into a world that isn’t on fire.

“That’s why we are calling on all UK savers to take the 21x challenge and ask their provider to go green in 2021, meaning that their scheme is committed to urgent carbon reduction targets, halving emissions this decade, and actively investing in solutions that help save our planet.”

Rob Barker, Managing Director, UK Savings & Retirement at Aviva, commented: “Pension savings have incredible potential for contributing towards climate goals. With over five million pension customers, and as the first major UK financial services company with a plan to meet Net Zero by 2040, we take our responsibility very seriously - which is why we commissioned this research. We’re excited to be working with Make My Money Matter to ensure people have a better understanding of how their pension can be used to create a better future.

“We recognise that many consumers now expect some level of sustainability to be built into whatever they buy. That’s why the investment and pension assets controlled by us are included in our 2040 sustainability ambition - the most demanding target of any major insurance company in the world today.”

Nick Robins, Professor in Practice - Sustainable Finance at the London School of Economics commented: “This is a very powerful piece of analysis, credibly showing how carbon emissions linked to the consumption of a financial service such as a pension can be compared with other parts of a person's lifestyle, such as diet, housing and transport.

“Shifting investment is an important way of sending signals to companies to accelerate action to support the net-zero transition. Shareholder engagement is another strategy, and the use of this tool can act to draw out how individual savers ensure that their pensions provide a lever for climate action. The study points to the need for individuals to build up their capacity to make informed climate choices over all aspects their lifestyle, not least finance.”

|