Group risk industry supports record number of families in 2016

UK Group Risk industry paid out £1.5bn in claims in 2016: a £100m increase on 2015, and equivalent to £4.1m a day

2,289 people were helped back to work with active early intervention support from an insurer

Cancer was the main cause of claim across all Group Risk products

Total benefits paid

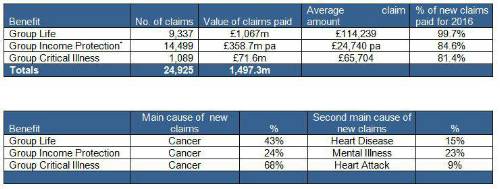

Group Life policies paid out total benefits to the value of £1.067 billion; Group Income Protection policies paid out a total of £358.7 million p.a.; Group Critical Illness policies paid out benefits totalling £71.6 million.

All three products show an increase in benefits paid out compared with 2015. Group Life policies paid out an increase of £67.2m, Group Income Protection policies paid out an increase of £11.7m p.a. and Group Critical Illness policies paid out an increase of £8.9m.

The average claims amounts (£114,239 for Group Life; £24,740 p.a. for Group Income Protection; £65,704 for Group Critical Illness) demonstrate that these are not just benefits for top earners. Everyone needs a way to protect their household’s financial position from the impact of death, illness, disability or accident, regardless of their salary, age or position, and employers are ideally placed to help their people to do this.

Facilitating return to work

For Group Income Protection, as well as the claims paid, there are a material number of cases each year where people are helped back to work before a claim becomes payable, often with the support of the insurer, the employer or both. GRiD has captured details of the cases where the insurer supported a return to work with some sort of active early intervention (such as fast-track access to counselling or physiotherapy) before that person was eligible for a monetary payment. 2,289 people were able to go back to work during 2016 because of such intervention.

This figure purely captures active early interventions (and does not capture those additional cases where people who had been claiming then returned to work). It represents 27% of all claims submitted (up 2 percentage points on 2015). This clearly demonstrates the effectiveness of early intervention, the value that insurers add beyond the pure payment of claims, and the positive outcomes that can be achieved when all parties work together.

Of the 2,289 people who benefitted from an active early intervention, 54% had help to overcome mental illness and 17% had support in overcoming musculoskeletal problems.

Main cause of claim

As in previous years, the main cause of claim across all three products was cancer – with the highest for Group Critical Illness (68%), followed by Group Life (43%) and Group Income Protection (24%).

Please see tables below for average claim amount and main causes of claim across all Group Risk products.

Paying claims

Group Risk insurers look for reasons to pay claims, and it is important for all policyholders that only valid claims are paid.

For Group Income Protection, the reason for not being able to pay claims in the vast majority of cases during 2016 was because the employee did not meet the definition of disability under the policy terms (i.e. they were still capable of doing their own job despite their reason for absence). For instance, an example to illustrate this is where an employee claimed because her husband was ill and she needed to care for him. She, herself, was not ill. The insurer’s decision not to pay the claim was upheld by the Financial Ombudsman’s Service (FOS).

For Group Critical Illness, the main reasons for turning down claims were:

• The employee’s condition not meeting the definition of critical illness being claimed for. 47% of declined claims in 2016 were turned down for this reason. For example, there was a case where someone wanted to claim for a heart attack when they had chest pains but hadn’t had a heart attack. The insurer’s decision not to pay the claim was upheld by FOS.

• The claim was for an existing medical condition that the employee had at the time of joining the scheme (Group Critical Illness policies generally operate with a pre-existing conditions exclusion). 37% of declined claims in 2016 were not paid for this reason. For example, if someone had already had breast cancer when they joined the scheme, no claims would be paid for any future occurrences of cancer. However, a claim could be made for an unrelated condition such as a heart attack.

• The employee tried to claim for a condition that wasn’t covered under the policy. 11% of declined claims in 2016 were not paid for this reason.

Katharine Moxham, spokesperson for GRiD, commented: “These figures give insight into the fantastic contribution of employer-sponsored group risk protection benefits in supporting people when they need it most. These policies pay out in dreadful circumstances for employees and their families. It’s excellent to be able to quantify the extent of the support we give as an industry through publishing these figures.

“It’s very affordable for employers to make a difference, but GRiD’s research regularly indicates that the cost of these benefits is overestimated or businesses don’t appreciate how much is included, which could also actually save them money elsewhere (for instance by not having to invest separately in a stand-alone Employee Assistance Programme or HR/legal advice).

“Employer-sponsored group risk financial protection cover is very good value. Basic level Group Life cover can be provided for around 0.5% of payroll, while a more comprehensive package – including Group Life and Group Income Protection benefits – typically costs less than 2% of payroll. There are few other benefits that cost just a few pounds a month per employee but can pay out thousands of pounds (or even millions) and that really make the difference between a family surviving financially or not.”

|