Retirees buying Guaranteed Income for Life (GIfL) last month could have generated 16% more income by choosing the best-paying plan over the worst, new analysis by retirement specialist Just Group reveals.

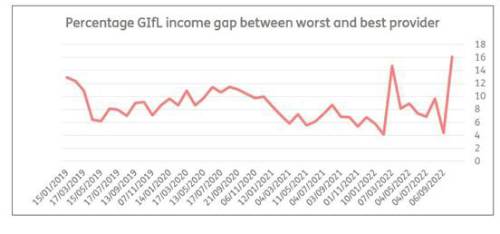

It is the largest gap between best and worst for at least four years and highlights the importance for retirees using their pension pots to buy annuities to shop around and be prepared to switch from their current pension provider.

Comparisons show that the worst paying standard GIfL plan would generate £3,137 income a year on a £50,000 purchase price for a 65-year-old retiree in good health. The best-paying generated

£3,642 or 16% more income. That is £505 a year extra income, or £12,625 over 25 years.

GIfL turns a pension pot into a secure income that will last a lifetime and nearly 70,000 plans were sold in 2021/221. With annuity rates rebounding from historic lows in recent years, the attractions of using GIfL to provide some retirement income is increasing, but Just Group is warning buyers to avoid the costly ‘loyalty trap’.

Stephen Lowe, group communications director at the retirement specialist Just Group, said: “Annuity providers are competing for your business so it’s likely you’ll get a better deal by shopping around – being blindly loyal may well cost you a smaller income for the rest of your life.

“The gap between the worst and best fluctuates typically between 5%-10% but recently it has touched 16% which is the highest we’ve seen for nearly four years. On a £50,000 pension, that represents more than £500 a year extra income each year for the rest of their life.”

He said there are some key guidelines for retirees considering accessing their pension cash to buy a guaranteed income for life now, at a time when returns have become more attractive.

“While it is tempting to take the path of least resistance and to simply sign up to whatever your pension provider is offering, that is likely to turn out to be an expensive mistake,” said Stephen Lowe.

“Instead, think about how much secure income you are going to need in retirement. You don’t have to make one big decision or just buy one type of plan. Book an appointment with Pension Wise, the government-backed free, independent and impartial guidance service, to find out more about your options.

“Retirement is quite a financially complex time of life, so think about using a professional financial adviser or a specialist annuity broker who can formulate a plan based on your personal circumstances and who can scour the market for the best solutions and deals.

“Make sure you get a chance to fully disclose details about your lifestyle and medical history. This allows providers to generate personalised rates which will be higher – sometimes significantly higher – than the ‘standard’ rates published in the newspapers and online which are usually based on people in good health.

“Finally, don’t settle for less. Don’t just shop around but be prepared to switch too – even small differences in rates can add up to large sums over the course of a long retirement.”

|