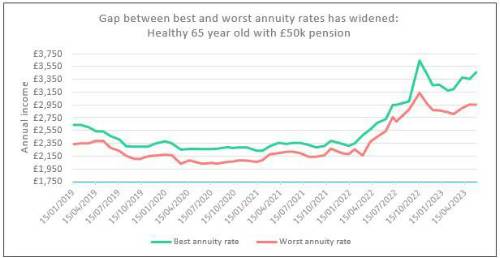

The income available to retirees buying Guaranteed Income for Life solutions is back on the rise but the gap between the best and worst rates has widened to its highest for more than four years, new figures from retirement specialist Just Group reveal.

Switching from the least to the most competitive provider can deliver nearly 18% more income, highlighting the importance of shopping around. This is equivalent to a 65-year-old in good health with a £50,000 pension receiving £3,470 a year (6.94%) income rather than £2,952 (5.9%) – equal to more than £500 a year for the rest of their lives.

“Annuity rates have been ticking upwards again in recent months which is encouraging more retirees to consider investing their pension pot in a Guaranteed Income for Life solution,” said Stephen Lowe, group communications director at Just Group.

“But some providers are pricing far more competitively than others and the gap between the best and worst

has widened to nearly 18% which is its highest for more than four years.”

Recent figures from the Association of British Insurers showed that more than £1bn of annuities were bought in the first three months of this year.

“After many years working towards higher take-up, it is good to see the number exercising their ‘open market option’ right to shop around rising to 64% but that still means more than one-third are likely to be missing out on income,” said Stephen Lowe.

“The easiest way to shop around effectively is to engage an annuity broker or a regulated financial adviser who can access all the latest prices on the market and suggest the most suitable options for each client in terms of spouse’s pensions, death benefits and inflation-protection.

“It is important retirees divulge their medical history and lifestyle factors because that can make a big

difference to the amount of income on offer.

“Annuities are the only retirement solution that offer guaranteed income for life which removes investment and longevity risk. Retirees often like to know they are receiving a core flow of secure income that they can spend this month knowing more is coming their way next month.

“It also offers retirees more freedom in how they use any pension savings they have not turned into a

guaranteed income.”

|