|

|

Retirement Advantage, has suggested the availability of longer guarantee periods can add significant value to annuities, as you can not only guarantee a lifetime income, but if you die early, an income stream to your beneficiaries, which far outweighs the original annuity purchase value. |

Since April, annuity providers have offered longer guarantees of up to 30-years, which can effectively guarantee your money back and more. Before the introduction of the pension freedoms, annuity guarantees were only available for up to 10 years.

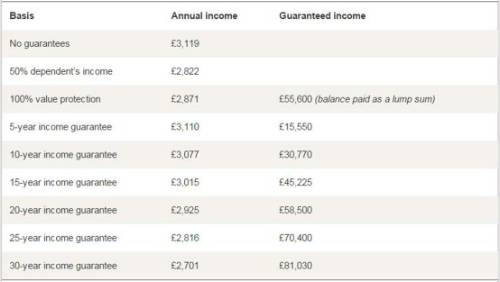

To illustrate the point, Retirement Advantage has created a case study of Mark, 65, who is looking for a lifetime income. Mark wants to ensure Susan, who is 60, is looked after when he dies. Mark has a pension fund worth £55,600 after he takes his 25% tax-free cash.

His options are:

Andrew Tully, pensions technical director, Retirement Advantage commented: ‘People are beginning to see annuities in a new light as they recognise the benefits of these longer guarantee periods alongside a lifetime income. The certainty of a risk-free income with the guarantee of at least your money back has addressed one of the key concerns that the insurance company keeps your money when you die.’

‘One in seven of all of our annuity applications is now for guarantee periods longer than 10 years, which is quite a shift in behaviour since April. A professional financial adviser will help you understand all of the options available, including the additional benefits of buying an annuity within drawdown.’

Retirement Advantage recently launched its innovative Retirement Account, which offers complete income flexibility and better death benefits than currently available from stand-alone annuities. Developed from scratch following the introduction of the pension freedoms, The Retirement Account incorporates a drawdown pot, a cash account and a guaranteed annuity, in one product, all within drawdown rules.

The same guarantees, options and comparable income are available from a stand-alone annuity and an annuity using The Retirement Account. However, the key difference is the additional flexibility the drawdown annuity offers over when and how any death benefits or income are paid, helping to control any tax liability.

|

|

|

|

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.