-

54% of drivers and 51% of homeowners were offered cuts after querying a renewal quote

-

Just 33% of car and 30% of home insurance switchers say their new insurer was better

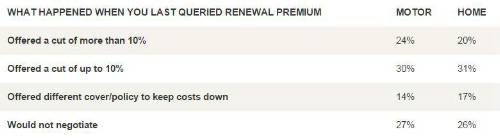

Its study shows 54% of drivers who phoned their existing insurer at renewal received price reductions with 24% saying they were offered substantial cuts of more than a tenth.

Around 51% of homeowners who haggled with their existing insurer achieved a price cut with one in five receiving a substantial reduction. On average just 27% of drivers and 26% of homeowners say their insurer would not negotiate.

However the research shows just 38% of drivers and 36% of homeowners always phone their insurer to query the renewal quote missing on potential savings and avoiding the need to switch to competitor.

The benefits of switching are not always obvious beyond a price cut – the study found just 33% of car and 30% of home insurance switchers found their new insurer was better than their previous provider.

Ian Hughes, Chief Executive of Consumer Intelligence said:

“Haggling with motor and home insurers clearly pays as drivers and homeowners who make the effort to negotiate have found.

“Insurers are generally receptive to renewal premiums being queried and will offer reductions to try and keep customers and the savings can be substantial at more than 10%.

“The benefits of switching are not always obvious as generally customers prefer to stay loyal and indeed our research shows that it would make more sense for insurers to offer their best price straight away rather than haggling.”

The table below shows insurers’ responses.

Consumer Intelligence’s research found an 11% rise in motor or home insurance premiums was on average the trigger for customers to consider switching – however 41% of drivers and homeowners say they always shop around

|