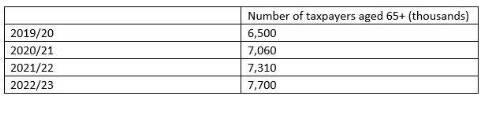

The Table below shows HMRC figures for the number of over 65s paying income tax for each year since 2019/20:

Source: HMRC Estimates: Table 2.1 Number of individual Income Tax payers

In April 2023, the personal income tax threshold will remain frozen at £12,570, but the following changes are expected to pensions:

- The state pension is expected to rise in line with CPI inflation in the year to September 2023; the August figure was 9.9%;

- Many occupational pensions will be increased because of inflation, though the exact rules may vary:

Public sector pensioners should see a rise in line with RPI inflation in the year to September 2023; in the year to August the increase was 12.3%

Private sector occupational pensioners will see an increase depending on their scheme rules – the majority are likely to get some form of inflation increase, but typically with a cap such as 5% or 2.5%;

In April 2022, the state pension rose by just 3.1%, yet the fact that income tax thresholds were frozen meant that the number of over 65s paying tax rose by 390,000 between last year and this year. With a much larger pension increase expected in April 2023, a much bigger increase in the number of over 65s paying tax is expected. LCP calculations suggest this is likely to be at least half a million more being added to the total. This would mean well over one and a half million extra over 65s being brought into tax since the General Election.

Commenting, LCP partner Steve Webb said: Freezing tax thresholds is a stealthy way of raising tax at the best of times, but at a time of soaring inflation, freezing thresholds has a profound effect. During this Parliament we have already seen over a million extra pensioners dragged into the tax net, and next April’s increase is likely to add at least half a million more. If the Chancellor is looking for ways to cut taxes and ease cost of living pressures on those on modest incomes, he could do worse than review the long-term freeze of income tax allowances”.

|