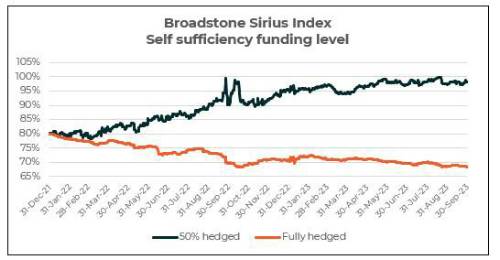

The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – posts its latest update.

The Broadstone Sirius Index finds that the 50% hedged scheme is nearing low dependency status after further improvements in its funding position through September.

The funding levels for the scheme rose from 97.3% at the end of August to 98.2% at the end of September.

Low dependency is reached when assets and liabilities for a defined benefit scheme are matched and the investment strategy is low risk meaning future reliance on the employer is not anticipated.

The fully hedged scheme saw its funding position slightly worsen, dropping from 68.6% to 68.4% through September.

The market environment through 2023 has been characterised by rising interest rates driving falls in both assets and liabilities protecting funding levels.

Chris Rice, Head of Trustee Services at Broadstone noted "The Pensions Regulator has been on a clear trajectory over recent years to reduce risk of underfunding in pension schemes and lessen the reliance on employers and investment returns to plug funding gaps. This direction of travel may be under challenge from the Government’s latest initiatives. However, in our experience pension schemes and their sponsors are content to continue on the journey to low dependency and then on to potential buy-out.

“It is good news that the half-hedged scheme we track is beginning to near full funding on a low dependency basis.

“The fully hedged scheme has been characterised by stability through 2023 despite small dips in its funding position. Protecting the funding level while interest rates have risen has meant the deficit has fallen in pound terms, so this scheme has also improved its position.

“The next steps for both schemes will potentially be deciding when the time is right to fully work towards implementing a low dependency investment strategy to reduce the reliance on the employer.

“Trustees need to be having discussions with their scheme actuaries and investment consultants around their best path to low dependency and, ultimately, buy-out.”

|