Sales of annuities are surging but new figures suggest half could be missing out on extra guaranteed lifetime income by failing to shop around for the best deal.

The Financial Conduct Authority’s flagship Financial Lives survey released last week shows that half (50%) of the pension savers who bought annuities in the four years up to mid-2022 did not compare deals from different providers.

The research also shows more than half (52%) did not know that people with health conditions could be offered higher incomes.

Stephen Lowe, group communications director at retirement specialist Just Group, said the research highlights a huge problem likely to be costing many retirees thousands of pounds over their lifetimes.

“Improving income rates are pushing up annuity sales sharply but far too many of those buyers are missing out,” he said. “Not shopping around is tantamount to refusing ‘free money’ that could add up to thousands of pounds over the course of a long retirement.”

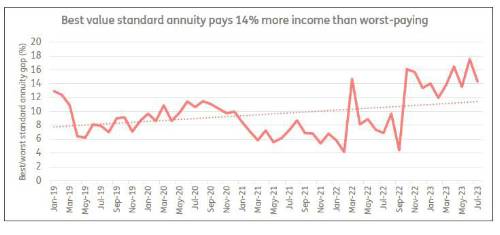

He said that, for a 65-year-old annuity buyer in good health, the best providers are currently offering about 14% more income than the worst, although the difference has recently been as wide as 18%.

The difference means the best provider would pay £17,880 more income than the worst over a 20- year retirement assuming an annuity bought for £100,000. The difference could be higher – perhaps much higher – once health and lifestyle factors are taken into account.

“Don’t accept your own pension provider’s offer because there are other companies likely to offer you more,” said Stephen Lowe. “You have to take your time to make sure you understand the options, then follow the two golden rules.

“First, you must disclose health and lifestyle information so the annuity you are offered is personalised to you and not just a standard rate. Then second, use that information to shop around all the providers for the best rate.”

He recommends that anyone thinking of accessing a pension should at least book an appointment with the free, independent and impartial guidance offered by the government-backed Pension Wise service to better understand their options.

A professional annuity broker or financial adviser can then help you to select the right options and shop around among all the providers on the open market to find the best deal.

“Buying an annuity doesn’t come with second chances,” he said.

“Choose wisely because the better the deal you get at the outset, the more income you will be able to enjoy for the rest of your life.”

|