-

48% of motorists find motor insurance confusing

-

Over half (51%) don’t understand how motor insurance is calculated

-

Motor insurance is a grudge purchase for over two fifths (43%) of the UK’s drivers

-

Co-op continues to drive transparency in the insurance industry

-

Today the Co-op releases a video to explain where driver’s money goes

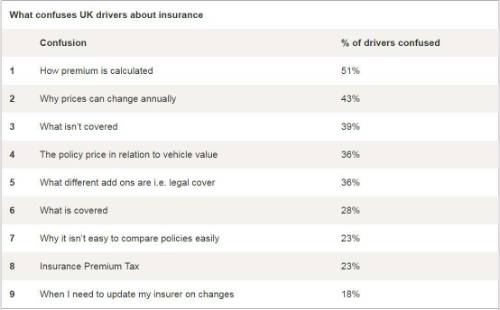

Research from the Co-op Insurance has found that over half (51%) don’t understand how their premium is calculated, two fifths are unclear why their premium price may fluctuate year to year and over a third (36%) don’t understand their policy price, in relation to their vehicle.

Research has also revealed that many people aren’t aware of some of the fundamental things that their premium is for. For example, 42% of drivers don’t realise it is in case another driver claims for personal injury, as a result of an accident that is their fault.

For two fifths of drivers, motor insurance is a grudge purchase, with over a tenth (15%) of drivers saying that they would not buy motor insurance if it wasn’t a legal requirement.

In response to this, the Co-op Insurance is today (2 June) launching the first, in a series of three, animated videos which has been designed to explain how insurance pricing works, to improve transparency for its customers.

The Co-op insurance is committed to improving transparency for its customers and members and this is the second part of a series of activity it has undertaken to do this, and make insurance easier to understand. Earlier this year it launched an online tool which was sent to over 10,000 home insurance customers, which was positively received, and fully explained how home insurance premiums are calculated.

The video aims to answer why premium prices cost what they do, in relation to the value of a vehicle. It explains what percentage of a motor insurance premium goes towards costs if a driver injured others, with a quarter** going towards this. It also explains how about a fifth of the policy premium price goes towards repairing damage to other people’s property. A fifth also goes towards a policyholders own car for things such as, theft of the vehicle or repairs to fix damage to a policyholder’s own car in case of damage. It also outlines business costs and Insurance Premium Tax.

James Hillon, Products and Pricing Director at Co-op Insurance, said: “Motor insurance can be complex and the research has found that drivers are often confused by it. The new video, which is the first in a series, aims to answer the age old question drivers have about the cost of their premium, in relation to the value of their vehicle.

“At the Co-op we want to keep communities safe and we hope that by explaining insurance it will help drivers to understand the value they get and reduce the chances of them deciding to go without insurance. Uninsured drivers have an impact on the cost of insurance generally, and can also lead to really unfair situations on honest road users if they are involved in an incident.

“At Co-op Insurance we are committed to doing the right thing for our customers. This is the second step, following a home insurance initiative earlier this year, in our journey to improve transparency and make insurance easier to understand.”

The video will be available on the Co-op Insurance’s website and will be promoted on social media.

|