Nearly half of pensioner homeowners over the age of 65 have never checked if they are entitled to State Benefits beyond their State Pension, research by advisory firm HUB Financial Solutions shows.

With living costs rising sharply, many struggling pensioner households could be missing out on hundreds of pounds in financial help they are entitled to receive.

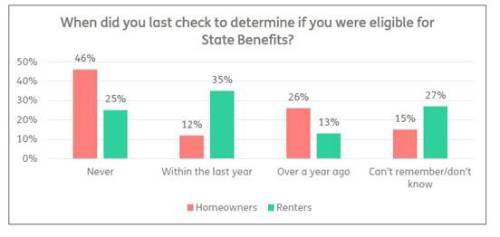

The survey of more than 1,000 over-65s found that 46% of homeowners had never checked if they were entitled to extra benefits, nearly double the 25% of those living in rented homes who had never checked.

And only 12% of homeowners had checked their eligibility for benefits in the last year, compared to more than a third (35%) of renters.

“With energy and food costs rising, it is important people struggling for income take up their benefits entitlement,” said Simon Gray, Managing Director of HUB Financial Solutions.

Although house prices have risen giving the average homeowner more wealth, the incomes they rely on to pay the day-to-day bills may have been outstripped by inflation.

“State pensioners received a 3.1% rise in April but the Consumer Prices Index rose 7% over the year to the end of March and many – including the Office for Budget Responsibility, the government’s own fiscal watchdog – are expecting further cost increases,” said Simon Gray.

“Benefits are made available to help people in a wide range of circumstances, whether they are struggling for income, having to care for a relative, have an illness or disability, or are entitled to a reduction in Council Tax.”

Research based on real client data collected by equity release advisers from HUB Financial Solutions revealed that nearly half (49%) of homeowners eligible for benefits were failing to claim any benefit, missing out on £1,197 a year on average. A further two in 10 (21%) were underclaiming the correct amount, missing out on £1,220 extra income.

“We have been tracking these figures for 12 years and every time have found a significant proportion of these homeowners are missing out on benefits that could make a real difference to their living standards,” said Simon Gray.

“The government’s own figures show that up to 850,000 households may be missing out on around £1,900 a year each, totalling nearly £1.7 billion in benefits that aren’t being claimed.

“Our concern is that the system is seen as complicated and inaccessible, particularly to older people. However, there are a range of resources and sources of support available to people to help them find out whether they could be entitled to additional benefits and how to claim. We would encourage everyone to make use of this help on offer to see if they are missing out.”

|