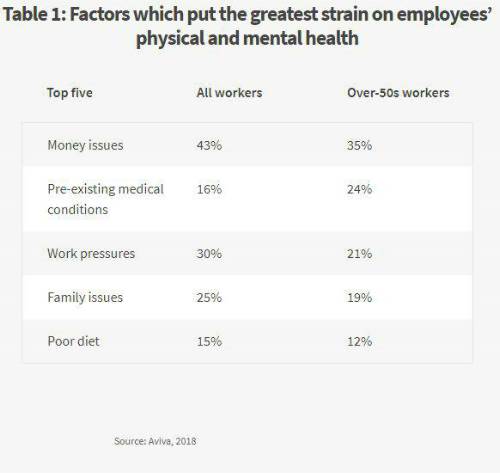

Work pressures are described by those surveyed as one of the greatest strains on their physical and mental health (21%), alongside money issues (35%) — which are also often linked to working life — and pre-existing medical conditions (24%).

Worryingly, more than half (53%) of workers aged 50+ do not feel supported by their employer when it comes to their wellbeing, a feeling which is much less prevalent among younger colleagues (falling to 34% of workers aged 16-49). In an indication of the type of support employees need to achieve fuller working lives, one in five (21%) agree employers should offer workshops or seminars on health and wellbeing in later life.

Work comes first - workers aged 50+ prioritise their job over their wellbeing

Aviva’s research also reveals improved health and wellbeing in the workplace could be achieved by encouraging employees to reassess their priorities, as almost two in five (37%) over-50s workers admit they often put their job above their health and wellbeing. While few people say they do not feel confident about their long-term career plans (27%), 38% are not confident about long-term plans for their health.

Greater communication is also needed, as more than a quarter (27%) of those surveyed do not feel comfortable telling their employer about any health issues they face as they grow older.

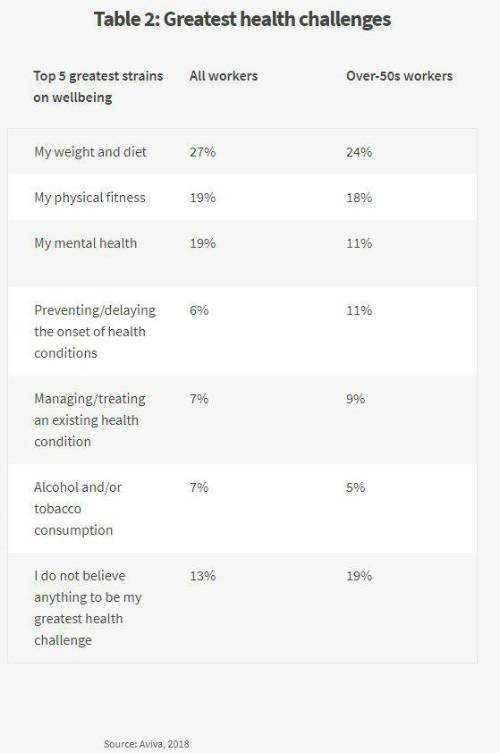

While the onus is partly on employers to do more to promote health and wellbeing within the workplace, employees also have a role to play; the two biggest health challenges among employees in the 50+ age group – weight and diet (24%) and physical fitness (18%) – are both issues that individuals can take steps to improve through lifestyle changes.

Lindsey Rix, Managing Director, Savings and Retirement at Aviva commented: “In our busy lives it is easy to neglect our wellbeing, but workers must put aside time to focus on their physical and mental health, ensuring this remains a top priority. As well as offering practical support, employers must ensure positive messages are communicated in the workplace. This will help staff to understand the importance of looking after themselves and create an open and trusting atmosphere where employees feel comfortable discussing any health problems.

"We recently piloted a Mid-Life MOT within Aviva to help give our employees a greater sense of empowerment over the choices they face beyond 50, with one of the key focuses being on health and wellbeing. By encouraging more conversations around the associated challenges of longer working lives, we hope both employers and their staff will feel motivated to tackle these issues head-on.

“Employers have a really important role to play both financially and emotionally in supporting their workers through periods of ill health and facilitating their return to the workplace where this is possible, and there are a range of services and insurance products available that can help them here.

“Greater clarity and support for health and wellbeing in the workplace will prevent employees, especially those closer to retirement, from having to retire prematurely and avoid a drain of valuable skills and talent.”

|