This year a fifth of adults in the UK said they planned on making New Year’s resolutions. The most common resolution is to become healthier (36%), with a third (33%) of people specifically committing to exercising more. Others are determined to improve their financial health by saving more (21%) or starting to invest (12%).

Resolutions to make more positive health choices, not only improve an individual’s over-all health but can improve their finances too. The benefits of giving up smoking are clear to both health and wealth as non-smokers tend to pay lower life insurance premiums. Those who quit the habit could save almost £1,000 on premiums.

Jennifer Gilchrist, protection specialist at Royal London said: “Many of us use New Year’s resolutions to alter our behaviour and daily routines, making positive changes in the process. Often people commit to making positive change from a health perspective but might not appreciate that they can also benefit by saving money – and realising that may help to improve their motivation to stick to their resolutions.

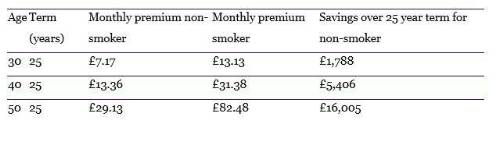

“When it comes to life insurance, smokers usually pay around twice as much as their non-smoking counterparts, rising to nearly three times as much for older smokers. So there’s potential savings, on top of not buying cigarettes, as well as health benefits to be had.

“Life insurance premiums take into account an individual’s over-all health, rewarding those that prioritise a healthier lifestyle with lower premiums. Royal London’s analysis highlights the substantial savings in the cost of life cover that can be made for non-smokers.”

A smoker aged 50 would pay nearly triple per month what a non-smoker of the same age would have to pay for the same sum assured, £29.13 compared to £82.48. This highlights how it could pay to quit the habit as, in this example, savings can amount to £16,005 over a 25 year term.

|