Aegon is warning savers with large amounts of money sitting in cash not to be lulled into a false sense of security if interest rates creep up, because of the threat of higher inflation throughout 2022. The FCA suggest 8.6 million consumers hold over £10k investable assets in cash and is planning to explore ways of supporting some of these people to invest.

Inflation is expected to average over 4% in the coming year, peaking at close to 5% in the spring. The BoE may look to dampen the effects of soaring prices by increasing the interest ‘base rate’ from the historic low of 0.1%. While this may offer some relief if passed on to savers, the average easy access savings account is currently sitting at just 0.19% and any upward change is expected to be small. The damaging effects of high and rising inflation will likely more than wipe out any uplift a higher interest rate will give to the value of cash savings.

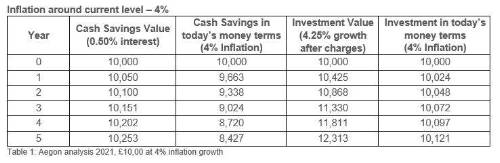

Aegon analysis shows £10,000 saved in a cash savings with 0.5% interest will increase to just £10,050 over the course of the year.

However, with inflation at 4%, this will be worth £9,663 in today’s money terms, reducing purchasing power by £337.

In this money were instead invested and achieved a moderate growth rate of 4.25% after charges, £10,000 could grow to £10,425 over a year. This would be worth £10,024 in today’s money terms with 4% inflation, just maintaining purchasing power.

Over the next 5 years, the difference becomes more apparent. £10,000 in cash savings will grow to £10,253 with 0.5% interest.

However, if inflation is sustained at the high rate of 4%, this would be worth £8,427, in today’s money terms, a loss of £1,573. In investments, this could grow to £12,313, or £10,121 in today’s money terms.

Steven Cameron, Pensions Director at Aegon comments: “As the economy continues to recover post lockdown, we are seeing a sharp rise in the cost of living. Inflation is currently sitting at over 4% and forecasts suggest it could remain around this level or higher in the coming year, peaking close to 5% in the spring.

“During a period of high inflation people will notice a dramatic decrease in their purchasing power over time, particularly if their wages don’t keep pace or if they have savings in cash. The Bank of England may respond by hiking the base rate in the coming months, but even if passed on to savings accounts, any increase is likely to be small. Savers hoping for a boost to their cash savings should not be lulled into a false sense of security if interest rates, currently just scraping above zero, rise a little.

“The lurking threat of inflation next year and beyond could far outweigh any small changes in interest rates for those with large amounts of money in cash savings. Following many years of low inflation, people may have forgotten how damaging high inflation can be. But in the coming months and years savers should think carefully about where they put any additional cash that is not needed in the short term.

“The financial regulator, the FCA, has said it wants to explore new ways of supporting some of the 8.6 million people with more than £10,000 of investable assets in cash to consider moving some of this into investments to make their money work harder. Money in investments can benefit from growth which can outstrip the rising prices of goods and services, although this is by no means guaranteed. A financial adviser is best placed to recommend the best investment option based on each individual’s attitude to risk.”

|