Early pension saving widens your options when it comes to deciding when to retire, according to analysis from Standard Life, part of Phoenix Group.

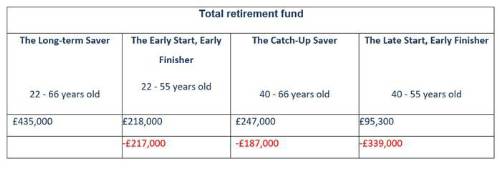

Standard Life looked at four scenarios to determine the savings outcome of an individual on typical earnings saving through the workplace:

- The Long-term Saver, saves from 22-66 on a starting salary of £25,000

- The Early Start, Early Finisher, saves from 22-55 on a starting salary of £25,000

- The Late Start, Early Finisher, saves from 40-55 whose salary at 40 is £46,500

- The Catch-Up Saver, savers from 40-66 whose salary at 40 is £46,500

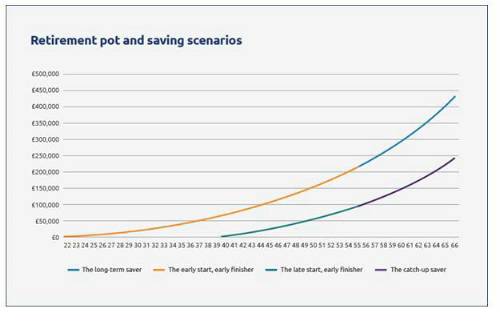

The analysis shows that the Long-Term Saver could accumulate £435,000 by age 66, not taking inflation into account. This assumes 3.5% salary growth per year and the standard auto-enrolment contributions (3% employee, 5% employer). By contrast the Catch-Up Saver could accumulate £247,000. While their salary level will by higher at age 40, they would need to make significantly higher contributions in order to catch the Long-Term Saver who benefits from additional years of contributions and investment growth on their pension. Indeed, for the Catch-Up Saver to build £435,000 by 66, their contribution level would need to be 14% of their salary.

Standard Life’s analysis also looked at the impact for those who choose to retire early at the current minimum pension age of 55. Those who saved from 22-55 could generate a fund of £218,000 while those who start at 40 and finish at 55 could have £95,300.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Dean Butler, Managing Director for Customer at Standard Life said: “It’s never too late to start saving and these figures illustrate that even over fifteen years, people can accumulate significant sums in their pension which benefit from employer contributions and tax relief. That said, what stands out is that the earlier you start, the greater your options. Over the years the combination of contributions and compound investment growth can really add up. If you are going to start saving later then it’s important to think carefully about contributions and what the standard auto-enrolment levels will generate in retirement.”

*Pensions savings are investments and so are subject to fluctuation. The above graph is for illustration only.

Standard Life offers tips to maximise pensions savings throughout your working life:

1. Make sure you’re taking advantage of all the benefits of your pension plan and your employer offers. If your employer offers a matching scheme, where if you pay additional contributions your employer will match them, consider paying in the maximum amount your employer will match to get the most out of it.

2. Keep an eye on how much is in your pension, on a regular basis. If you know how much you have, you can work out how close you are to the retirement lifestyle you want. As UK workers now move jobs every 5 years on average, you might find you have a number of small pots- it might be worth considering bringing them all into 1 to make your savings easier to track.

3. Getting a bonus this year? Deciding to pay some or all of your bonus into your pension plan could save you paying some big tax and national insurance deductions. Meaning you could keep more of it in the long run, and it could be a great way to give your pension savings a boost.

4. Even a small amount could make a big difference in the long term, especially if you’re starting young. If you’re able to, think about paying a little more into your pension when you get a pay rise or have a little extra savings.

|