|

|

DB pension transfer activity increased over the course of June for the third month in a row, the latest edition of XPS Pension Group’s Transfer Watch has found. The Transfer Activity Index showed that an annualised rate of 75 members out of every 10,000 members are now transferring their pensions, the highest level seen since July 2020. |

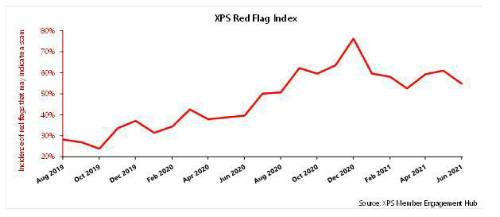

The Scams Red Flag Index fell in June, but still remains at a very high level, with 55% of transfers showing at least one warning sign of a potential scam or the potential for poor member outcomes. There was a very small fall in the Transfer Value Index, reflecting a continued period of stability in the financial markets. XPS Pension Group’s Transfer Watch monitors how market developments have affected transfer values for a typical pension scheme member. It also monitors how many members are choosing to take a transfer from their DB pension scheme and, through its Red Flag Index, the incidence of scam red flags identified at the point of transfer. On 6 July, the Government published its response to the Work and Pensions Committee’s report on the first phase of its inquiry “Protecting pension savers – five years on from the pension freedoms”. In it, the Government rejected the committee’s recommendation that the upcoming Online Safety Bill should do more to tackle online advertising of fraudulent pension products. Mark Barlow, Head of Member Options, XPS Pensions Group commented: “We have seen fewer transfers and retirements over the past twelve months, so it’s no surprise that we’re now seeing an increase in activity as lockdown restrictions are eased. Whilst scam warning signs remain so high, and with no immediate prospect of laws combatting fraudulent online pensions adverts being strengthened, it’s as important as ever that trustees and employers take steps to support and protect their members.”

Chart 2 – XPS Red Flag Index

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.