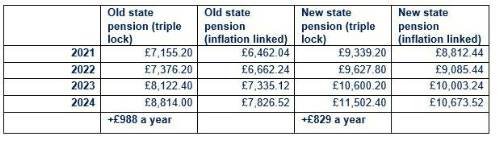

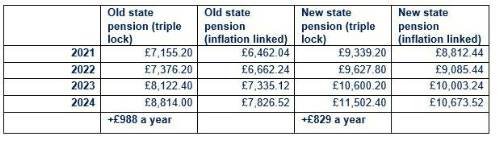

New analysis from Standard Life, part of Phoenix Group, reveals that pensioners will be over £800 a year better off from April as a result of the triple lock. The analysis examined how payments would have increased if they were uprated by inflation alone versus the triple lock over the last three years and highlights just how valuable the current uprating system is.

The state pension has risen under the triple lock since 2012, which means that it rises in line with the highest of; average earnings in the three months to July; the previous September’s inflation figure or 2.5% each year.

Thanks to a bumper wage growth figure in July 2023 of 8.5%, the new state pension for those receiving the full amount will increase to £11,502 a year, while the basic (old) state pension, for people who reached state pension age before 2016, will reach £8,814 per year.

If the state pension was linked to just inflation alone, the basic state pension would be £7,826 and the new state pension would be £10,673. Meaning those on the old state pension are set to be £988 better off a year and new state pensioners £829 better off due to the triple tock.

The power of the triple lock

The state pension passing £11k means more pensioners will pay tax, given the personal allowance freeze

In less good news the state pension is increasingly close to the personal allowance limit – the amount of income people can receive before paying tax. The personal allowance has been frozen since the 2021/2022 tax year. In 2021/22 the new state pension was equivalent to 74% of the allowance, today it is 92%. So, pensioners will need just £1,068 of income before they start paying income tax.

Dean Butler, Managing Director for Retail at Standard Life said: “Pensioners are set to see a healthy boost to their incomes next month as the state pension amount passes £11,000 for many for the first time. Despite high inflation over the past two years, the triple lock has led to a fairly significant boost above and beyond CPI. This will be hugely welcome news to pensioners who rely on the state pension for a large portion of their retirement income, many of whom are among the most vulnerable people in the country. There are of course many well off pensioners too so increases will undoubtedly reignite debate around the long-term affordability of the state pension, and the sustainability of the triple lock.

“It’s also important pensioners are aware of the potential tax implications, with the personal allowance set to be frozen until 2028. The personal allowance has remained flat in recent years and will gradually be bringing more and more people into the tax system as result – including pensioners with only very low incomes above the state pension.

“There are a few steps people with modest private savings whose annual income is likely to be around the personal allowance limit can take. While 25% of pension savings can be withdrawn tax free, the remainder can be taxed. For those incomes hovering around the personal allowance, it's worth ensuring they’re not taking bigger lump sums on which they might pay tax if they can be avoided. If they do have any ISA savings these are not subject to income tax so could be useful source of additional income.”

|