The government is considering increasing the state pension age earlier than planned.

Under the current law, the state pension age it will rise from 66 to 67 by 2028, and then 68 between 2044 and 2046. However, the government is considering making the change even earlier, with some reports citing a rise in state pension age to 68 by 2034

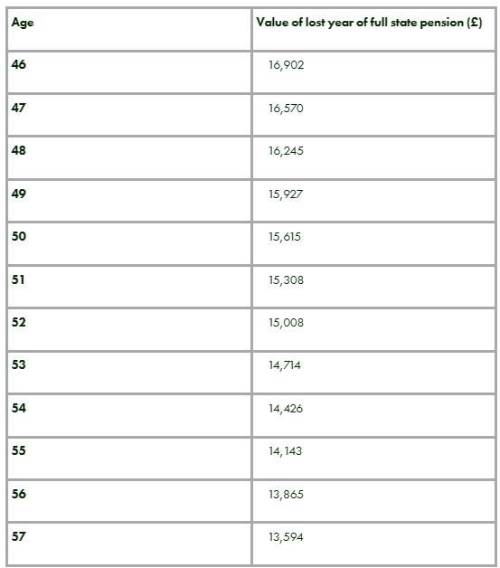

New calculations by interactive investor shows that bringing forward the state pension age increase from 68 by 2046 to 68 by 2034 could mean a year lost full state pension payment of £13,594 for workers aged 57 rising to £16,902 for workers aged 46.

The calculations factor in the new full state pension of £203.85 per week (£10,600 over the year) and assumes an inflation-linked uprating of 5.2% (forecasted by the Bank of England) and 2% inflation a year thereafter (the Bank of England’s target inflation rate).

Potential lost year of full state pension payments if the government the state pension age increases to 68 by 2046 to 68 by 2034. Assumes a 5.2% inflation uprating in 2023 and 2% annual rise thereafter.

Alice Guy, Personal Finance Editor, interactive investor, says: “The planned rise in state pension age will leave more people facing poverty in retirement and disproportionately affects carers and those with health problems.

“The changes mean that workers who are currently 57 or younger won’t get their state pension until they reach 68, rather than 67 as planned.

“Someone with a £100,000 pension pot who retires at 67 will see their money running out two years earlier, when they reach 79-years-old rather than 81-years-old. That’s because they will need to withdraw an extra £10,600 from their pension pot to tide them over until they get the state pension at 68 (assuming 4% investment growth and 2% inflation).

“It's not as simple as asking older workers to work for longer. interactive investor’s 2022 Great British Retirement Survey showed that only one in three (34%) 56-to-65-year-olds still work full-time – close to half as many as those under 56 (60%).

“Many older workers face health problems or are working fewer hours due to caring responsibilities.

“ii’s 2022 Great British Retirement Survey showed that more than one in five (21%) of 56-to-65-year-olds have cut their hours due to ill health. In addition, 13% of 56-to-65-year-olds have reduced their hours due to caring responsibilities – a responsibility that falls disproportionally on women - 18% of women have cut their hours due to caring responsibilities compared to 7% of men.

“On respondent commented that, “You can make all the plans you want, but if you have to give up work to become a full-time carer it all goes out the window.”

“For those who are younger, it’s important to prioritise pension saving so you have more options once you near retirement age. Saving £200 per month in your pension for 40 years could give you a retirement income of around £18,000 by the time you reach retirement age, assuming 5% investment growth.”

Commenting, Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Pushing back the state pension age would come as a kick in the teeth to workers who diligently paid into the welfare system under the assumption that the state pension age won’t move much – if at all.

“Our calculations show that bringing forward the state pension age from 68 by 2046 to 68 by 2034 could mean a year lost full state pension payment of £13,594 for workers aged 57 rising to £16,902 for workers aged 46. This is by no means a small sum and could force savers to tweak their retirement plans to maintain course for a comfortable retirement.

“Shifting the state pension goal posts just a little bit could save the government billions in state pension payments and more money will end up in the taxman’s coffers in taxes on extra earnings. Workers would be forgiven in thinking that their state pension entitlement has been kicked around like political football. We need a public confidence boost in state and private pensions, rather than erosion.

“A lot of people rely on the state pension as their core source of income at retirement. The stark reality is pushing back the state pension age will make having an affordable retirement harder for many savers.

“The change in the state pension age could also have a knock-on consequence on private pensions as the government’s intention is that the normal minimum pension age for private pensions should be ten years below state pension age -, although they are not automatically linking the two at this time).

“This situation lays bare the importance of private pension savings. Britons will have to do most of the heavy lifting to ensure a healthy income at retirement. Planning for retirement is difficult when the state pension regime is up in the air.”

|