Bronek Masojada, Chief Executive of Hiscox Ltd, commented:

"Hiscox has had another good year. We have been able to grow profitably in insurance and position Hiscox Re sensibly, reducing premiums and attracting new capital in the face of tough conditions. The strategy of diversification we have pursued for decades means that, whatever the headwinds, we have the firepower to set our own course. We have the strategy, brand, people and capital support for a rewarding future."

|

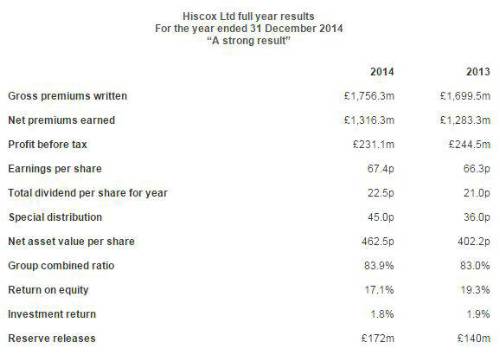

Highlights

-

Strong premium growth in insurance of 8.8%, including 24.1% for Hiscox USA.

-

Record profits in Hiscox UK and Europe of £73.3 million (2013: £56.4 million).

-

Retail businesses now over half the Group’s gross premiums written, with retail profits now covering the standard dividend.

-

Hiscox London Market profit before tax of £62.6 million (2013: £63.1 million), growing with consistent profitability.

-

Hiscox Re reducing premiums as planned by 13.9% and delivered good profits, with new products and Kiskadee ILS funds on track to reach $500 million by mid-year.

-

Long-term investment in brand, product and distribution provides opportunities for profitable growth throughout the cycle.

Capital return

-

Capital return of 60.0p per share, approximately £192 million, by way of E/F share scheme and share consolidation.

-

This comprises a special distribution of 45.0p per share and final dividend equivalent of 15.0p per share, taking the total dividend for the year to 22.5p, an increase of 7.1% (2013: 21.0p).

|