Director of Policy, Steve Webb, was commenting following receipt of a letter (dated 18th June) from HMRC about the position of higher earners who are members of Defined Benefit pension schemes. Under current rules, where a member of a scheme builds up rights in excess of the *standard* annual allowance of £40,000 the scheme has a duty to inform the member of this fact. This information can then be included in the member’s tax return.

However, many thousands of people will be caught by the ‘tapered’ annual allowance whereby their allowance is reduced below £40,000 because their total taxable income, including the growth in their pension rights, exceeds £150,000 in a given year. For these people they may have an annual allowance anywhere between £10,000 and £40,000. Since their DB scheme cannot possibly know the annual allowance that applies to such individuals, the scheme will not notify them if they exceed their annual allowance. For example, if someone has a personal annual allowance of £25,000 and accrues £30,000 in DB rights, they will be over their own limit but the DB scheme will not know this.

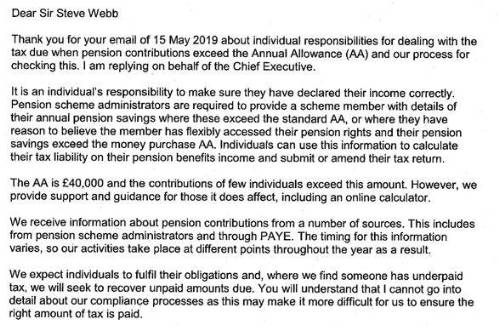

Steve Webb therefore wrote to HMRC to ask about such situations and how individual scheme members were expected to give the right information on their tax return if they get no information from their DB scheme. HMRC’s reply (which is pasted below) simply fails to address the issue. It says that the number of people accruing more than £40,000 is relatively small (which is true, but irrelevant) and says that the duty is on an individual to comply with the law and make accurate declarations on their tax return.

Commenting, Steve Webb said: HMRC clearly live in a parallel universe where taxpayers perfectly understand the tapered annual allowance and the way that DB accruals are tested against it. A system designed for a world where everyone faces the same £40,000 annual allowance simply does not work in a world where different people have different annual allowances. At the moment, taxpayers are being left to their own devices. When filling in a tax return they need to work out their own unique annual allowance – assuming they know that the tapered annual allowance exists – and then get information from their DB scheme to see if they have exceeded their personal annual allowance. I strongly suspect that, out of ignorance, many thousands of people have entered a zero on their tax return for the question about exceeding the annual allowance and may be in for a nasty shock months or years later”.

HMRC REPLY

|