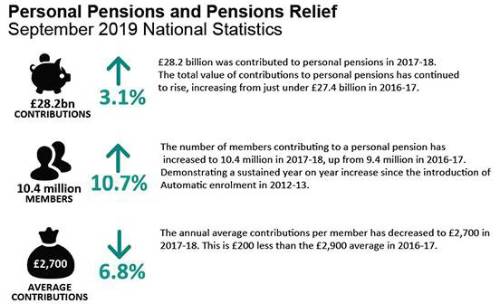

Key findings from the release include:

• £28.2 billion was contributed to personal pensions in 2017-2018

• This is an increase from just £27.4 billion in 2016-2017

• The number of members contributing to a personal pension has increased to 10.4 million in 2017-2018

• The annual average contributions per member has decreased to £2,700 in 2017-2018

• This is £200 less than the £2,900 average in 2016-2017

Mark Pemberthy, Head of DC Wealth at Buck, said: “It’s encouraging to see that today’s figures show pension participation continues to move in a positive direction. More people than ever are participating in their workplace pension schemes and it’s clear that auto-enrolment is having a positive impact on the overall DC pension landscape and people’s pension savings. However, while a greater number of employees are putting money aside for their retirement, these figures also show that most people are continuing to chronically underfund their retirement.

“Most DC schemes are not designed to generate adequate retirement incomes and as a result most employees are not saving enough to provide the standard of living they want or expect in retirement. So, is it time for the pension industry and employers to question what the point of DC pension schemes really is? If these schemes are supposed to be the primary way for employees to save for their retirement, then contribution levels need to increase significantly. It’s vital for all parties involved with pensions to be more honest about likely DC retirement outcomes so that we avoid a generation of DC disappointment. We need to clearly signpost what employers and employees need to do to take greater responsibility for financial security in retirement.”

HMRC’s latest personal pension stats

|