Based on more than seven years of data and millions of home insurance customer quotes, the research shows that the average combined home insurance cost now stands at £146.72, the highest since 2013 where prices peaked at £154.43.

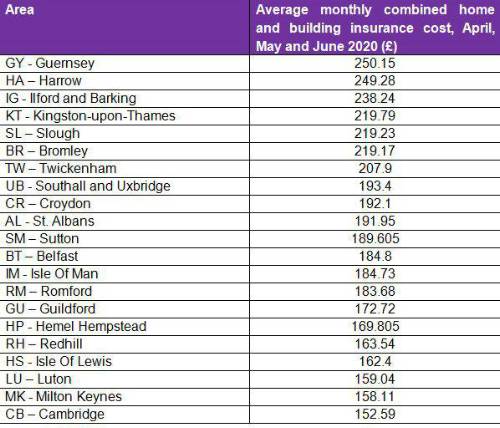

Some areas of the country even exceeded 2013 costs during the lockdown months of April, May and June 2020, with 21 areas witnessing the highest premiums ever recorded by MoneySuperMarket. Guernsey’s costs are the most expensive of these, rising 16% since 2019 to over £250 per month.

Areas recording their highest combined home and building insurance average price on record in April, May and June 2020 (highest to lowest prices)

Combined home insurance costs are 29% higher in July 2020 (£146.20) than they were in early 2017, when they were at their lowest (£113.30). Premiums rose by 4.16% nationwide over the past year and 2.08% between March and July 2020.

Looking at buildings-only insurance, the lockdown months of April, May and June saw the highest average premiums ever recorded by MoneySuperMarket (£112.59). This trend was clearly visible across the UK, with nearly half (46%) of all areas recording their highest ever buildings-only premium.

Year-on-year, average buildings-only prices rose by 11% to £112.59. Meanwhile, contents-only policies increased by 6% over the same time period.

Kate Devine, Head of Home Insurance at MoneySuperMarket, commented: “There are several possible drivers behind the continuing rise in premiums. Covid-19 lockdown – which ran from 23 March until restrictions started to ease in June – may have played a part. With many people remaining constantly at home – schooling, working and even exercising – the rate of accidental damage becomes significantly higher, and more claims spell higher costs for insurers.

“In the coming months, as the nation maneuvers the recession, it’s likely the home insurance costs will fluctuate. For example, the government’s stamp duty break is encouraging a spike in home moves, which could potentially cause a subsequent impact on home insurance costs.

“Our advice to consumers is to shop around for the best deals. This has never been more important to ensure you are able to stay on top of your finances. By comparing the best home insurance deals and switching to more favourable rates, there are good savings to be made.”

You can find out more about home insurance prices and how they have changed in your area on the MoneySuperMarket website.

|