AA Insurance Index records little change

But premiums expected to rise during 2017, says AA

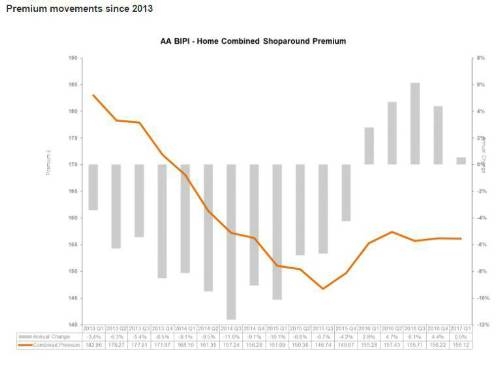

Home insurance premiums have moved little over the first quarter of 2017, according to the AA’s benchmark British Insurance Premium Index.

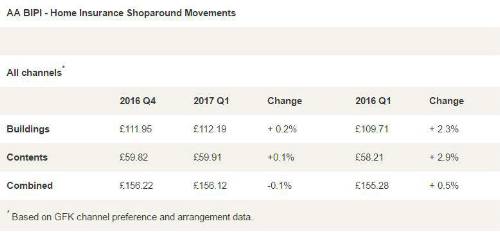

The average quoted Shoparound premium for a typical home Buildings and Contents policy fell over the three months ending 31st March 2017 by just 0.1% to £156.12 – a fall of 10p. Over 12 months, the cost has risen by only 0.5%.

The Shoparound quote for standalone buildings and contents policies however, rose slightly over the quarter: for buildings, a rise of 0.2% added 24p to the typical quote, to £112.19 while just 9p has been added to contents cover, rising by 0.1% to £59.91.

Over 12 months the Shoparound* quoted premium (an average of the five cheapest quotes for each in a nationwide ‘basket’ of customers) rose by 2.3% for buildings and 2.9% for contents:

Michael Lloyd, the AA’s insurance director, says: “Although over the year home insurance hasn’t been far from the headlines with the creation of Flood Re, designed to enable families most at risk of flooding to obtain affordable insurance, the cost of cover has remained relatively stable.

“However, over recent months the weather has been quite benign and most have enjoyed another relatively storm-free winter.

“Insurance Premium Tax (IPT) increased to 10% from last October and will rise again to 12% in June 2017 and we expect a 2% inflationary increase for policies being taken out or renewed from the beginning of June.

But he believes that further falls in premium – despite an increasingly competitive market – are unlikely. Various industry reports suggest that insurers are on the verge of returning underwriting losses and some increases in premiums can be expected over the coming year.

Lloyd also underlines the importance of home owners ensuring their property is properly covered, pointing out that underinsurance is an issue in the home insurance market. “I believe that price comparison sites have encouraged price to focused on to the exclusion of product features – as a result, buyers may not entirely be aware of what they are covered for. Now might be a good time to review your cover if you haven’t done so for some time”.

Lloyd notes that Insurers must also now declare a home owner’s previous year’s premium on renewal. “I believe this will only encourage more people to change insurance cover more often. That in turn is likely to discourage insurance companies from offering introductory discounts if they don’t expect to renew business after the first year.

“I believe that, combined with the further increase in IPT, will see premiums going up again this year.”

Winners and losers: combined Buildings & Contents policies

Premiums by region

All but three regions have seen premiums fall over the past quarter, the biggest fall (0.6%) in the Border & Tyne Tees region where the typical quote for a combined policy has fallen to £150.39. The two regions that have seen increases are London and the South (up 0.2%) which remains the most costly area to insure a property at £165.03; and Scotland (up 0.3% to £151.13) The cheapest region to insure a property remains the West and West Country with a small decrease of 0.4% to £146.25.

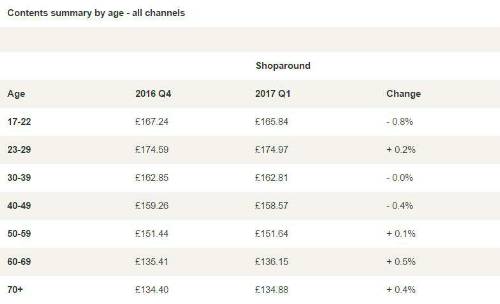

Premiums by age of insured

Three age groups saw their typical quote for a Buildings & Contents policy quote fall this quarter. Those aged 17-22 saw the largest drop: 0.8% to £165.84. The biggest rise was at the opposite end of the age scale: quoted premiums for those aged 60-69 jumped by 0.5% to £136.15. The over 70 age group also saw a rise, of 0.4% to £134.88 and remain the group paying the lowest premiums.

|