Almost two-in-five (38%) pensioner homeowners over the age of 65 have never checked if they are entitled to State Benefits beyond their State Pension, research by advisory firm HUB Financial Solutions reveals1.

With the impact of the cost of living crisis still squeezing finances and borrowing rates remaining high, many pensioner households could be missing out on thousands of pounds in much-needed income which they are entitled to receive.

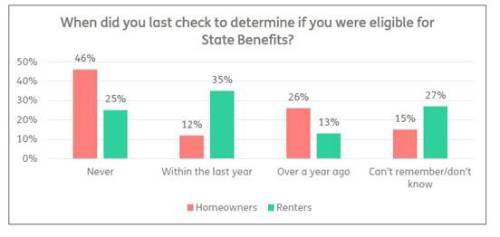

The survey of more than 1,000 over-65s found that 38% of homeowners had never checked if they were entitled to extra benefits, more than double the proportion of those renting (15%).

Despite government efforts to boost State Benefit take-up via campaigns and extra cost of living payments, only one-in-five (20%) homeowners said that they had checked their eligibility for benefits in the last year, compared to over four-in-10 (41%) renters.

“While inflation may be coming down, many pensioners will still have seen their budgets squeezed over the past few years. And the recent announcement by the Chancellor to limit winter fuel payments to those on pension credit or other means-tested benefits underlines how important it is for people to check their eligibility,” said Matt Halksworth, head of customer solutions and advisory leader at HUB Financial Solutions.

“However, our research suggests many homeowners are not even checking to see if they could be entitled to valuable financial support from the government. It suggests than many pensioners may think that owning a home could exclude them from benefits such as Pension Credit.”

Research from Just Group, the sister company of HUB Financial Solutions, exposed the scale of the problem and the financial damage that failing to claim State Benefits can inflict on eligible pensioner homeowners.

Through in-depth fact-finding interviews with clients seeking advice on equity release during 2023, the firm found that of pensioner homeowners entitled to receive benefits, eight in 10 (79%) were failing to claim any benefit with each household missing out on an average of £1,231 a year extra income.

One in 10 (9%) were claiming but receiving less than their entitlement, on average missing out on an additional £476 a year income. The latest government statistics on State Benefit take-up3 for the financial year ending 2022 demonstrate the extent of benefits pensioners are missing out on. Up to 880,000 pensioner families who were entitled to receive Pension Credit did not claim it.

Similarly, up to 360,000 pensioner households did not claim housing benefit despite being eligible for the support.

By failing to claim, these households missed out on roughly £2,200 (pension credit), and £3,400 (housing benefit) in annual income with a total of £2.1 billion (pension credit) and £1.3 billion (housing benefit) going unclaimed, respectively.

“It is particularly disheartening to see so many homeowners aged over 65s are not checking their benefit entitlement when we know so many are eligible and missing out on significant amounts of income.

“We urge pensioners, homeowners or otherwise, not to simply assume that they are not entitled for support, and instead to take full advantage of the many free-to-use resources that can help individuals identify their eligibility for benefits and how to claim them.”

|