by Laura McLaren, Scheme Actuary at Hymans Robertson

Nevertheless, there are actions you can be taking now in order to understand the risks you’re exposed to and how best to manage them. Here we explore what these actions are, and how many trustees are already taking the necessary steps to prepare.

What are the 5 most important steps you should be taking?

Test the potential impact on scheme funding and agree a contingency response to any material deterioration

Review sponsor covenant for adverse changes – impact will be different for every business

Consider whether your investment strategy remains suitable (including a review of investment triggers, liquidity, hedging levels and currency exposure)

Manage any implications for ongoing administration and consider how to communicate with your members

Keep an eye on wider operational aspects and progress on longer-term legal/regulatory issues

What actions are trustees already taking?

According to our research, almost two-thirds of trustees haven taken steps to prepare for the impact of Brexit. Despite the difficulties of preparing for the unknown, it’s encouraging that so many trustees are taking these proactive steps.

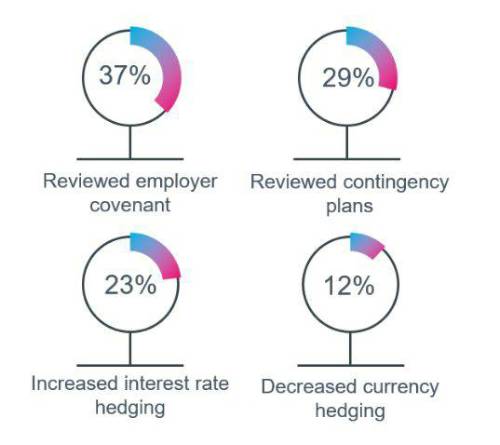

Reviewing contingency plans and the covenant of your sponsoring employer are key areas to keep under review until the impact of Brexit becomes clearer. We’re pleased to see 29% and 37% trustees have already carried out these respective actions.

Many trustees have also taken protective measures in anticipation of market instability. Almost a quarter (23%) have increased their interest rate hedging in anticipation of a fall in yields and 12% have decreased their currency hedging. With yields falling over 20bps in March alone, this decision is already paying off for schemes that decided to increase their rate hedging.

Next steps

While it’s encouraging to see so many trustees have already taken precautions, we hope to see more follow suit as the Brexit deadline becomes closer. Fully understanding the risks you’re exposed to, and putting appropriate mitigation measures in place, will improve security for you and your members despite the continued uncertainty surrounding Brexit.

|