By Fiona Tait, Pensions Specialist at Royal London

This is an issue which the recent Pension Policy Institute (PPI) paper “Value for money in DC pensions” tries to address.

I was fortunate enough to be at the launch, which included contributions not just from the PPI, but also from representatives from the DWP, the Pensions Regulator (tPR) and the FCA Consumer panel.

Definitions of value

All the panellists noted the problems that are created by a lack of a common definition of VFM. As evidenced by their annual reports, the Independence Governance Committees (IGCs) attached to workplace pensions each had to approach the issue in their own way, and the report notes that various regulators have different definitions as well. All of this makes it very hard to compare schemes or to create minimum standards and benchmarks. Despite this the DWP confirmed that they were not looking to introduce a legal definition and would prefer the industry to come up with their own solutions.

The PPI have suggested 3 common themes which members can relate to:

• The value of the pension fund

• The security of their pension pot

• The level of trust in their scheme

The first is clearly measureable, the latter two not quite so simple. To resolve this, the report concentrates on identifying the factors that can create a positive outcome in each of these areas. Identifying whether, or to what extent, these factors are present could help assess the overall VFM.

Fund Value

The fund value can be directly affected by a number of factors, which can themselves be influenced by other measurable characteristics of the scheme:

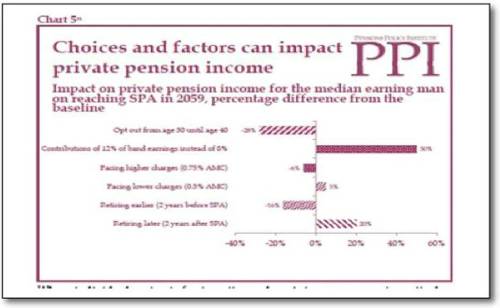

• Charges are the most obvious factor to look at however the PPI found that slightly increasing or decreasing charges had a relatively small effect on the end fund value. Charges need to be competitive but other factors may be more important.

• In contrast, higher contribution levels are highly likely to deliver significantly better fund values, so it is not unreasonable to suggest that schemes which offer more than the minimum required rates are most likely to deliver the best outcomes.

• Schemes with lower opt-out rates are also likely to deliver higher fund values, since members are invested for longer, particularly where workers also tend to retire later.

Security

The report considers that “good governance can be the lynchpin for driving better value for money”. Proper governance can ensure that a scheme offers suitable investment defaults, effective administration and potentially lower charges.

In terms of investment the schemes default investment option must be suitable for the demographics of the scheme members. Volatility management is seen driving value both by increasing certainty of outcomes and minimising losses which might cause members to take fright and reduce their savings.

Independent governance is also likely to increase transparency of charges. Charges have fallen in recent years but there are still concerns around transaction costs which have been highlighted by several of the IGCs.

A strong scheme governance report from the relevant ICG is also therefore a good indicator of value for money.

Trust

It is difficult to measure trust, but you can monitor the quality of scheme design and communications. Scheme members who are kept informed are more likely to commit to saving more and make better choices with their investments. As shown above, the behaviour of scheme members themselves has a significant impact on retirement outcomes. Scheme features such as employer-matched contributions, auto-escalation or other “nudges” could be an indication of the employer’s commitment to the scheme.

Schemes which help their members to understand the key decisions they have to make and support positive action will deliver good value. This may be most significant at the point of retirement. Whilst IGCs are not required to consider decumulation, the report considers it would be beneficial for them to do so in order to avoid their members being steered towards products which are not suitable to their needs.

Clear signposting towards guidance and/or advice is likely to add considerable value for the member.

In summary

Workplace pensions are collective vehicles and it is not possible to deliver best value for every member. Trustees should however consider the options that will benefit most of them.

The presence, or not, of some of the features mentioned above can and should be used as indicators of value for money. So long as charges are reasonable it is these features which are likely to make the greatest difference to the member’s eventual retirement income.

|